Financial distress: Reading the signs in your supply chain

The construction industry is notorious for late, reduced or non-payment. It is a sector where inspections, quality of work and exact specification can all be called into question and where contractors have a proclivity to ‘pay when paid’. Add to this the challenges and financial uncertainty caused by Brexit, and the current economic turbulence we are all facing and it is easy to see why the financial situation is critical for many small construction businesses in the UK.

The key to success is obvious – find and keep reliable, solvent customers. Reducing the risk of non-payment is fundamental, especially if you are a supplier or purchaser in a longer supply chain. But how can you read the signs and know where to go for information on supply chain partners?

It can be time consuming to find and tricky to understand key financial information regarding potential clients. Companies House only offers abbreviated accounts and you won’t be able to view turnover or profit and loss. You can search online for CCJs and judgements against people and firms. But being able to effectively rate a business and understand whether a company is likely to stay solvent and pay on time can be a Herculian task.

Embracing technology and using online tools is a good start to navigating a supply chain and finding successful, solvent customers. Companies such as TenderSpace (www.thetenderspace.com) and its comprehensive suite of cloud-based, due diligence tools, allow clients to keep track of potential issues and receive alerts when there is a significant change in the financial standing of an organisation.

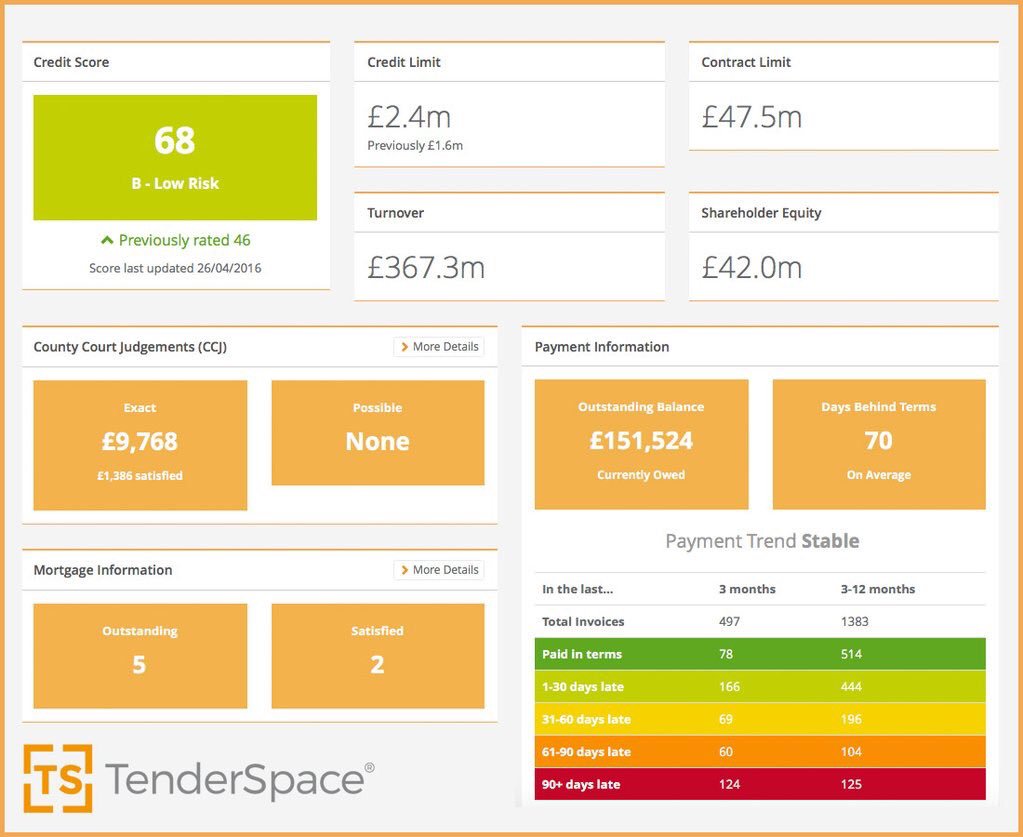

Amongst a host of tools, TenderSpace offers the crucial Finance Checker. It allows you to check the credit rating of potential and existing suppliers, ensuring they are solvent and are likely to continue to be so. Unless you perform a credit check, you just don’t know whether a client is capable of paying you.

The TenderSpace Finance Checker allows you, with just one click, to view information such as company details and directors, financial history, profit and loss, KPIs up to 10 years, credit score and limit, payment trends, CCJs and more. It works by using a Rating Model – a highly predictive analysis tool that can give you a view of your current and future customers.

The Finance Checker not only credit checks but also will notify you with any changes. It is a simple-to-use system that provides you with information that will allow you to make informed decisions about who to work with and will help you find steadfast suppliers and reliable customers. So how does it work?

Rating Model

The TenderSpace Finance Checker uses a Rating Model to do one thing: predict which UK companies are likely to fail within the next year. It was created by analysing companies that had failed within the previous 12 months and searching for commonalities.

To fail: a definition

The Rating Model defines the following as failure:

• In Receivership/Liquidation

• Administrator Appointed

• Appointment of Liquidator

• Meeting of Creditors

• In Receivership/Administration

• Administrative Receiver Appointed

• Administration Order

• Company is liquidated or is wound-up

Rating Bandings

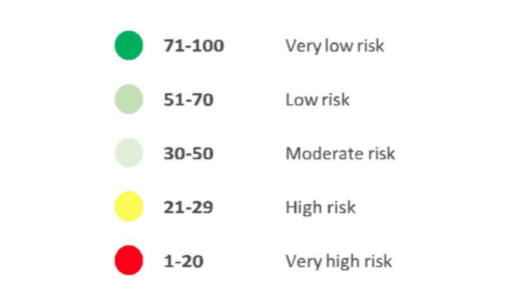

Companies are rated 1 to 100 on a scale of risk. Higher risk companies get a low ranking, low risk companies rank highly. The Rating bandings is an easy-to-use segmentation tool which allows you to asses our rating model in 5 simple segments. TenderSpace Finance Checker also compares companies with similar business and then ranks companies by their likelihood of becoming insolvent, allowing for further and more insightful decisions.

Today’s technology means businesses can keep track of all aspects of the supply chain, from checking finances, to asking pertinent questions of potential clients and identifying problems early. Technology can help increase transparency and improve the business environment for the UK’s small businesses.

This article was created by TenderSpace, whose free Finance Checker, developed in conjunction with CreditSafe, offers critical decision making information and live updates on possibly detrimental financial changes.

Featured articles and news

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.