European hydronic controls market 2019 - 2021

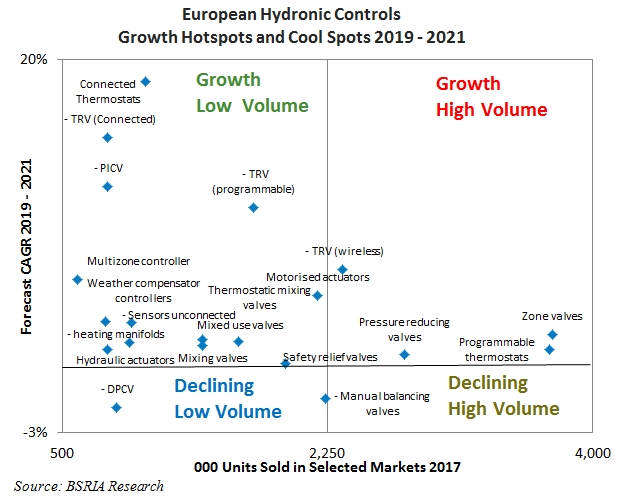

Connected thermostats, connected thermostatic radiator valves (TRVs) and pressure independent control valves (PICVs) will be the biggest growth drivers in a generally rather “patchy” European market according to BSRIA’s latest study of the hydronic controls market in five major European Markets, published in February 2018.

These key findings are from a study of five major European markets: France, Germany, Italy, Poland and the UK. The studies cover all valves, actuators and hydronic controls (such as sensors and thermostats), for both the residential and commercial markets.

BSRIA forecasts the value of the market for connected thermostats will grow in 2019 - 2021 by between 14.8 per cent CAGR in Poland and 26 per cent CAGR in the UK. Germany, France and Italy are forecast to show growth between these figures. This is being driven by the rapid growth in uptake of smart home solutions and by the desire of consumers to have remote access to their thermostats so that they can have more control over their heating, comfort and energy consumption.

Connected TRVs are forecast to grow by between three per cent CAGR in Italy and 28 per cent CAGR in France, offering control at room level with a device that many users can fit for themselves.

The market for PICVs is predicted to continue its robust growth, with market value in 2019 – 2021 forecast to increase at just under 10 per cent CAGR in France and Poland and almost 15 per cent in Germany and the UK. This reflects the interest of the commercial sector in managing hydronic systems more efficiently.

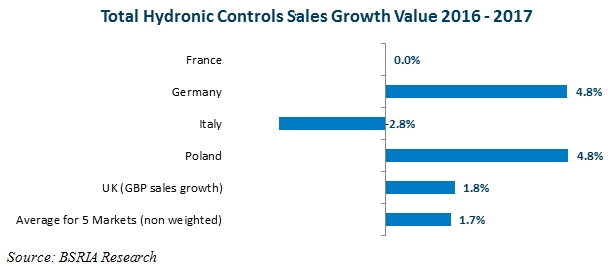

[Image: Total hydronic controls sales growth value 2016 – 2017.]

Germany and Poland both experienced significant growth in overall hydronic controls market value in 2016 – 2017. In Germany this reflects a strong economy and a robust residential construction market.

A key factor in the growth experienced in Poland is the rise in building standards.

In France the market was flat, while in Italy it declined overall. However, the decline in Italy was driven by a major drop in TRV sales in 2017 following regulatory changes, as all other categories have witnessed growth. In the UK the market saw weak growth in sterling value, but declined when measured in Euros, reflecting a difficult political and economic situation.

Germany remains by far the biggest hydronic controls market with a total product value of over one billion Euros in 2017, with the UK second with just over half that value, followed by Italy. The French market is comparatively small, partly reflecting the strong penetration of electric heating in the French residential market.

[Image: European hydronic controls growth hotspots and cool spots 2019 – 2021.]

In most markets the value of the actuator market is increasing faster than that for valves, reflecting the demand for more sophisticated actuators. Manual control valves and manual radiator valves are forecast to decline in most markets, as are manual thermostats.

Henry Lawson, Senior Market Research Consultant, WMI, said:

“...these studies confirm two fundamental facts about the European hydronic controls market. The first is that it is a mature market which broadly tends to grow or decline in line with the construction industry combined with economic conditions in a given country. The second – and more exciting fact – is that hydronic controls are being strongly influenced by the general demand for smarter and more connected controls, linked to the growth of the Internet of Things in general and to the movement towards smarter buildings and smart homes in particular. These reports shine a light on this important trend.”

This article was originally published by BSRIA as ‘Growth in European Hydronic Controls market set to sprint’ in March 2018. Ref https://www.bsria.co.uk/news/article/growth-in-european-hydronic-controls-market-set-to-sprint/

--BSRIA

[edit] Related articles on Designing Buildings Wiki.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.