ECA partners with adviser to help members navigate R and D tax relief

ECA has partnered with leading R&D tax adviser Forrest Brown to help Members navigate changes to R&D tax relief.

ForrestBrown works with businesses across the electrical engineering sector, offering full R&D claim preparation services through to enquiry support and ad-hoc consultancy advice.

The electrical contracting sector continues to evolve despite ongoing challenges, ranging from skills shortages to material costs. For many, R&D tax relief is a tool that can help overcome these challenges, though a number of major changes to the incentive have been announced, coming into force from April 2023.

Many ECA members will be familiar with R&D tax relief. For many businesses in the electrotechnical sector the incentive is a valuable source of funding that helps to underpin new projects, tackle challenges and even keep businesses ahead of market competition.

In his 2002 Autumn Statement, the Chancellor reaffirmed the government’s commitment to increase UK R&D spending to £20 billion a year by 2024-25. However, it was also confirmed that HMRC is tightening its approach to R&D tax relief. From new submission requirements to a bolstered compliance team, there has been a marked change in their approach to reviewing claims, and the number of enquiry notices is on the rise.

With significant reform from April 2023, ECA Members are strongly encouraged to determine how the reforms will affect any claims for tax relief that they intend to make.You can read more about the imminent changes as announced in the Autumn Statement and in additional steps HMRC are taking to ensure compliance. Here, you will see new information about the pre-notification of claims to HMRC (in some circumstances), the provision of ‘additional information’ in support of a claim, and more.

This article appears on the ECA news and blog site as 'ECA partners with leading R&D tax adviser ForrestBrown' dated March 8, 2023.

--ECA

[edit] Related articles on Designing Buildings

- Advanced construction technology.

- Case study.

- Construction innovation.

- Development appraisal.

- Innovation in construction projects.

- Innovative partnership procedure.

- Modern methods of construction.

- Qualitative research and the built environment.

- Research and development in disaster response

- Research and development in the construction industry.

- Research and development tax credits.

- Research and development tax relief.

- Research in the construction industry.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

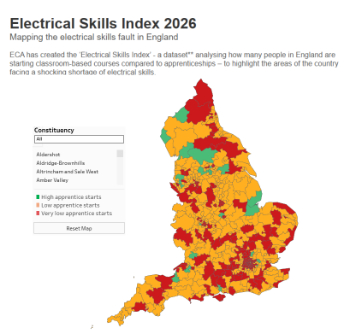

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Comments

[edit] To make a comment about this article, click 'Add a comment' above. Separate your comments from any existing comments by inserting a horizontal line.