World compressors study 2022

|

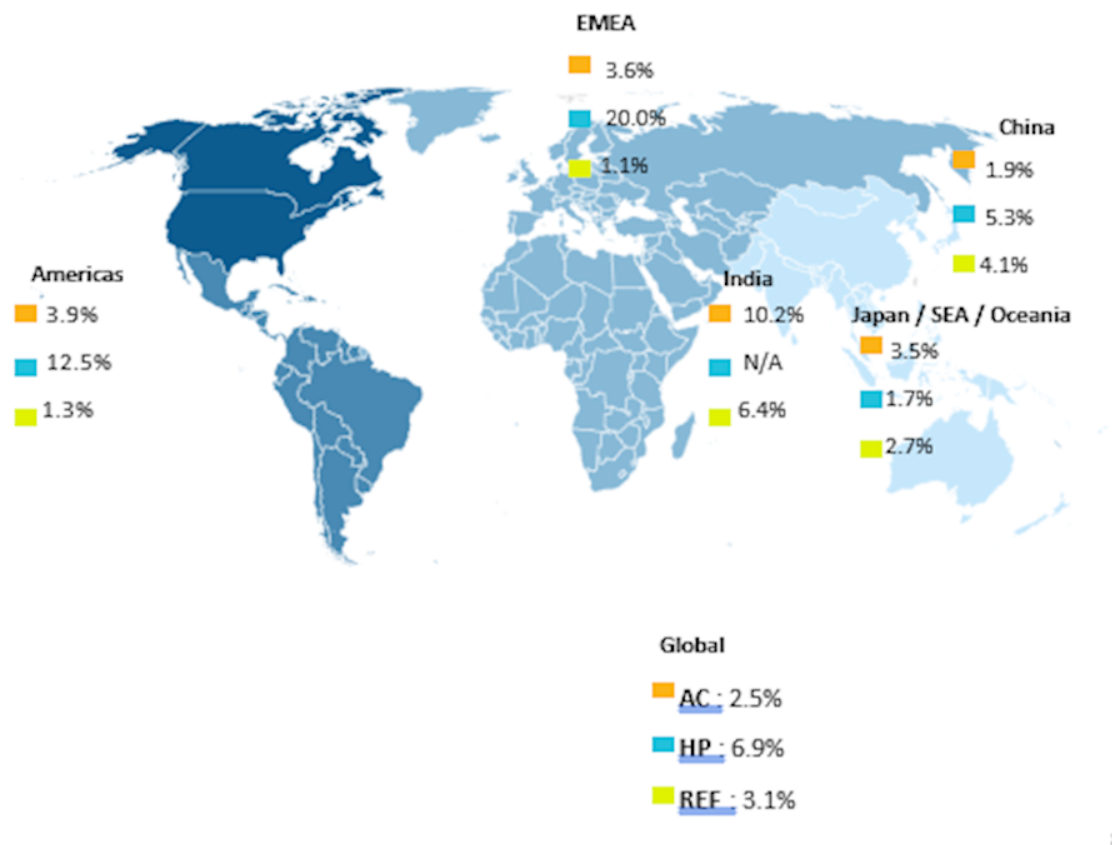

| CAGR of compressor sales by volume 2021 to 2026. |

In October 2022, BSRIA announced that it had completed an update of the World Compressor study, which analyses sales of compressors worldwide for applications in Air Conditioning (AC), Heat Pumps (HP), and Refrigeration (REF). The study is composed of five separate regional reports: Americas, EMEA, India, China, and Rest of Asia. In the latter the data is segmented between Japan and the other Asian countries – South-East Asia, Oceania.

This ambitious project uses as a basis the extensive knowledge and experience built over the years through research BSRIA carried out in all three application segments, worldwide. It provides insightful details on market sizes, trends and drivers to answer the information needs of all stakeholders.

The new study is aimed at updating the analysis for sales of compressors for the current year (2022), as well as extending the outlook for sales up to 2026. Forecasts are correlated with the extensive portfolio of studies published by BSRIA this year in the fields of AC, HP, and REF, as well as the latest macroeconomic analysis.

Sales experienced a significant decline in 2020, caused by the outbreak of Covid-19, but the global compressor market recovered forcefully in 2021 and was estimated at 502.1 million units in 2022 (3% growth), while value was shored up due to inflation, at USD 48.6 billion (15% growth). This includes compressors for air conditioning (207.3 million units), heat pumps (5.4 million), and refrigeration (289.4 million). This strong rebound has already placed the market above its pre-pandemic level. It was propelled in particular by rotary compressors in air conditioning applications.

Reciprocating compressors dominate the market in volume with an estimated 288.0 million units sold in 2022, as the use of small hermetic for household and light commercial appliances accounts for the bulk of sales. In second place come rotary compressors (197.0 million), which are sold mostly for AC applications and heat pumps and have been bolstered by the surge in sales of residential HVAC systems. Scroll are in the third position with 17 million units, this compressor type is being challenged by rotary in the lower capacities, but on the other hand they are gaining traction in larger capacity segments, as their performances increase.

Screw and centrifugal compressors, both standard and oil free, account for a much smaller share in number of units, yet they command together a sizeable market value of USD 3.3 billon thanks to their high selling prices. By 2026, the compressor market is expected to reach the total value of USD 52.5 billion, its highest performance ever, as applications in air conditioning, heat pumps and refrigeration will continue to expand.

In addition, drivers such as energy efficiency, the uptake of refrigerants with a lower environmental footprint, and the improvements in compressor capacities and performances are expected to push the value of the compressor market higher by leveraging sales growth.

All the market analysis carried out for the World Compressor study was supported by the extensive portfolio of market reports published over the years by BSRIA in the HVAC & Refrigeration sectors, worldwide.

For more information contact BSRIA at www.bsria.com/uk.

This article was originally published on the BSRIA website in October 2022. https://www.bsria.com/uk/news/article/world_compressors_study_2022_update/

--BSRIA

[edit] Related articles on Designing Buildings

- Air compressor.

- BSRIA articles on Designing Buildings Wiki.

- BSRIA Compressor Study September 2020 - The Americas and China.

- Compression refrigeration.

- Ground source heat pumps.

- HFC phase out.

- R22 phase out.

- R404A phase out.

- Refrigerant selection.

- Refrigerant.

- World air conditioning, heat pump and refrigeration compressors market March 2022.

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.