World air conditioning, heat pump and refrigeration compressors market March 2022

In 2022, BSRIA completed a study of the global market for compressors used in applications for air conditioning, heat pumps, and refrigeration. The set of six reports covers Americas, China, EMEA (Europe, the Middle East and Africa), India, Japan /rest of Asia, and a combined World overview. Each regional report consists of detailed data on compressor sales and an analysis of the trends in the market.

“In 2021, the world market for compressors was estimated to reach 486 million units. The impact of COVID-19 has eased and all segments have resumed growth.”

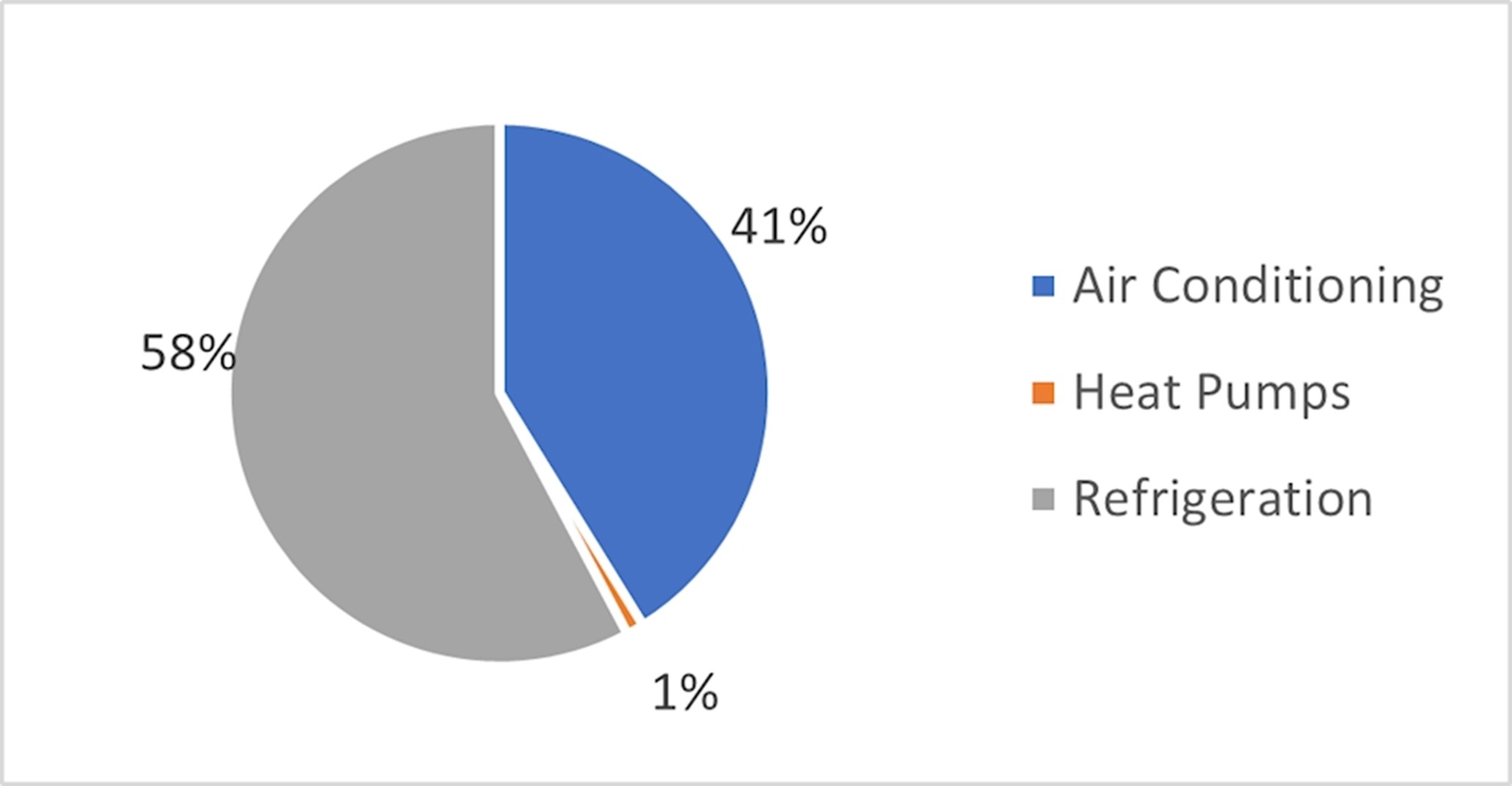

The global compressor market has recovered forcefully and is estimated at 486 million units in 2021, and a value of USD 42.4 billion. This includes compressors for air conditioning (200 million units), heat pumps (5 million), and refrigeration (281 million). This strong rebound, driven in particular by rotary compressors in air conditioning applications, places the market above its pre-pandemic level.

Reciprocating compressors dominate the market in volume with an estimated 279 million units sold in 2021, as the use of small hermetic for household and light commercial appliances account for the largest segment. In second place come rotary compressors (190 million), which are sold mostly for AC applications and heat pumps. Scroll are in the third place with 16 million units; this compressor type is being challenged by rotary in the lower capacities, but they are gaining market share in larger capacity segments as their performances increase.

Screw compressors are largely used above a threshold of 250-300 kW, in both AC and REF applications. Centrifugal oil-free compressors compete with screw but their use is more limited, due to their cost premium. Screw is expected to be a dynamic market with sales progressing steadily up until 2023, encouraged by the implementation of inverter technology. Oil free centrifugal compressors are expected to gain market share in AC and heat pumps, while standard centrifugal remain consistent.

China is by far the largest producer and purchaser of compressors, in particular rotary and scroll, which are used in the assembly of finished products. However, with the US-China trade war, and the signing of the RCEP (Regional Comprehensive Economic Partnership) transforming Asia into the largest free-trade bloc in history, change is expected with production of AC units shifting to other countries such as Thailand, and sales of compressors growing as a result.

In Americas, refrigeration is the largest segment in the market, totalling 19.5 million units in 2021, with high volumes of hermetic reciprocating compressors for residential applications. Air conditioning is the second largest application with 8.6 million units, a drop of 10.3% compared with the previous year due to COVID-19. Rotary and especially scroll account for the largest share of AC compressors. The heat pump market is somewhat nascent in Americas, with a mere 0.4 million compressors sold for this application, concentrated in North America.

With the rapid growth taking place in the residential AC market in EMEA, accompanied by a rise in production, sales of rotary and scroll compressors to this region are expected to surge.

The heat pump market in 2020 held up remarkably well especially in EMEA despite COVID, and their future looks bright as they are surfing a wave of legislation and other drivers for the decarbonisation of buildings.

India is yet a small compressor market, but it is forecast to grow rapidly as production of AC and REF units is expanding. There is as yet no heat pump market in this region, and it is almost non-existent in SEA countries (Southeast Asia), where the strongest potential exists in AC markets.

World HAC&R compressors by application, by volume (units), 2021

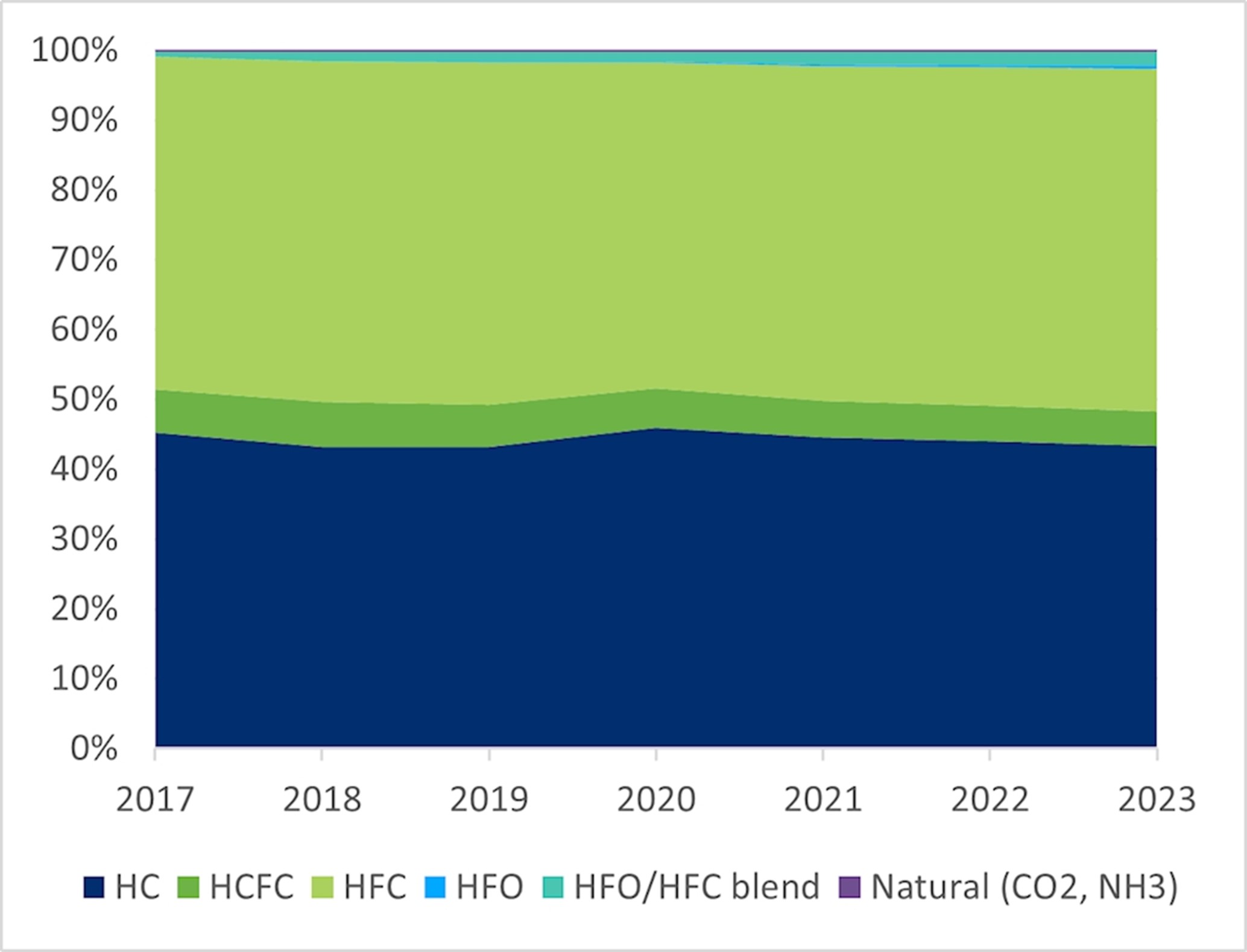

Penetration of refrigerants by type, % of volume (units), 2017 - 2023

For further information about the study, please contact:

- European sales enquiries: BSRIA UK: www.bsria.com/uk/

- America sales enquiries: BSRIA USA: www.bsria.com/us/

- China sales enquiries: BSRIA China: www.bsria.com/cn/

This article originally appeared as ‘World HAC&R Compressors’ in March 2022.

--BSRIA

[edit] Related articles on Designing Buildings

Featured articles and news

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

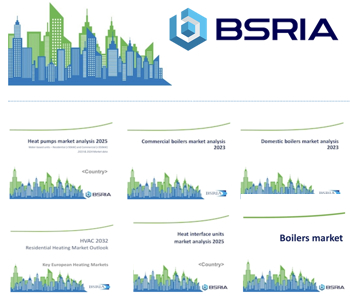

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

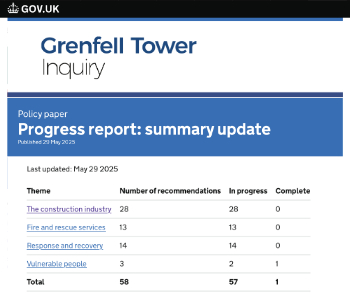

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.