State of the construction trade

[edit] Summary of the Construction Products Association's Construction Trade Survey for 2017 Q4.

[edit] Financial Concerns Hit Construction’s Largest Sectors

The proportion of companies in the construction supply chain struggling with rising costs for raw materials, labour and energy has remained elevated in each quarter in 2017 according to the Construction Products Association’s Construction Trade Survey for 2017 Q4.

The survey found that although activity continued to increase for main contractors, SME builders, product manufacturers and specialist contractors during the quarter, civil engineering firms reported the first fall in workloads in four years. Net balances for orders, enquiries and expected product sales for the year ahead weakened, and contractors reported lower orders in the commercial, infrastructure, industrial and public nonhousing sectors. Combined, these sectors account for over 40% of total construction output.

Rises in fuel and energy costs were prevalent among heavy side product manufacturers, reflecting the lagged impact of Sterling’s depreciation during 2016 on hedged commodity prices. This, in combination with existing price pressures for raw materials and labour, has intensified the cost inflation passing through the supply chain. Overall, costs were reported higher for 82% of civil engineering contractors, whilst raw materials increased for 82% of main contractors and 91% of light side product manufacturers.

Commenting on the survey, Rebecca Larkin, Senior Economist at the CPA, said: “The Q4 survey marked the fourth consecutive quarter of falling profit margins among building contractors. This combined with Carillion’s liquidation at the start of this year, only emphasises the financial strains exerted by a protracted period of rising costs passing through the supply chain. Falls in new orders reported in the four sizeable sectors of commercial, infrastructure, industrial and public non-housing add another downside to the outlook for 2018 given the early signs of slowing activity at the end of last year.”

Brian Berry, Chief Executive of the Federation of Master Builders (FMB), said: “Smaller building firms in the construction sector fared well in the final three months of last year. The latest figures demonstrate an underlying resilience in the industry with many firms reporting increased workloads and an increase in enquiries. However, now is no time for complacency as growth among construction SMEs is slowing. Firms have reported record highs in terms of problems hiring skilled trades such as bricklayers, carpenters and plasterers. With Brexit just around the corner, this problem could well be exacerbated if our access to skilled EU workers is diminished. What’s more, the acute skills gap has caused salaries to spike and material prices remain high. Together these factors are squeezing margins for smaller builders.”

CECA Director of External Affairs, Marie-Claude Hemming, said: “These disappointing figures show that more must be done to unlock planned infrastructure investment and bring schemes to market. CECA calls on Government to do more, by committing to projects outlined in the National Infrastructure Delivery Plan, and to continue to develop projects to add to this pipeline to secure the future of the UK economy. Our hopes are that the decline in workloads during 2017 Q4 is representative of a pause in activity, rather than a sign of broader decline.”

Key survey findings include:

- On balance, 22% of main building contractors reported that construction output rose in the fourth quarter of 2017 compared with a year ago

- One-third of specialist contractors reported a rise in output during Q4

- 4% of civil engineers, on balance, reported a decrease in workloads during Q4

- On balance, 20% of SME contractors reported increased workloads in Q4 compared to three months earlier

- Main contractors reported that order books were lower in industrial, commercial and public non-housing

- 10% of civil engineering firms reported a decrease in new orders in Q4, on balance • 15% of SMEs and half of specialist contractors reported an increase in enquiries in Q4, on balance

- Overall costs increased for 82% of civil engineering contractors, whilst 82% of main contractors, 87% of heavy side manufacturers and 91% of light side manufacturers reported raw materials costs rose in Q4

- 17% of main contractors and specialist contractors reported a fall in profit margins in Q4

Original article published by Emma Salmon, CPA,12th February 2018.

Construction Trade Survey 2017 Q4 available from CPA.

--Construction Products Association 16:42, 26 Feb 2018 (BST)

Featured articles and news

One of the most impressive Victorian architects. Book review.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

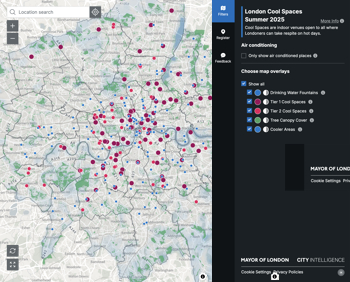

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.