Overheads

In accounting, the term ‘overheads’ refers to expenses that are paid by an organisation on an ongoing basis. Overheads can be fixed (i.e. the same each month) such as rent on office buildings, or variable (i.e. fluctuating depending on business activities) such as delivery costs. Overheads can also be semi-variable, where part of the expense is incurred at a fixed level and another part fluctuates, such as utility charges.

In construction contracts, overheads are often priced proportionately against a project and are the calculated costs of running the company contracted to carry out a project. Often these costs are described as head office administrative costs (in some cases there may also be factory or manufacturing overheads).

Head office costs might include; property costs, finance charges on loans, insurances, staff, taxes, external advisors, marketing and tendering activities and so on. Most contracting organisations will calculate a percentage against project costs to be set against each project somewhere between 2.5% and 5% to cover head office services.

Site overheads such as site accommodation, insurance, and so on, are generally accounted for separately and in contractual terms are included in the preliminaries element of the contract.

On prime cost contracts the contractor is paid for carrying out the works based on the prime cost (the actual cost of labour, plant and materials) and a fee for overheads and profit. This fee can be agreed by negotiation or by competition, and may be a lump sum (which it may be possible to adjust if the actual cost is different from the estimate), or a percentage of the prime cost (which it may be possible to revise if the client changes the nature of the works).

[edit] Related articles on Designing Buildings

- Business.

- Business plan.

- Cash flow statement.

- Cost information.

- Cost overruns.

- Cost planning.

- Direct cost.

- Estimate.

- Head office overheads.

- How to calculate head office overheads and profit.

- Loss and expense.

- Margin.

- Organisation.

- Preliminaries.

- Profit.

- Profit and overheads.

- Project overheads.

- Revenue.

Featured articles and news

The challenge as PFI agreements come to an end

How construction deals with inherit assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working in this procurement route .

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

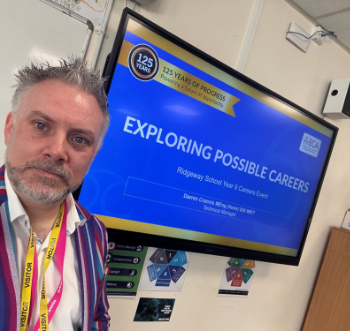

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.