Mixed partnerships

Contents |

[edit] Introduction

Many professionals working in design and construction have established themselves as a Limited Liability Partnership (LLP) and some of these may be 'mixed partnerships'. This means that the members of the LLP are both corporate and individual members.

It is perfectly permissible for a company to be a member of a LLP and there are a variety of reasons why it may be considered appropriate or necessary for such an arrangement to be put in place. For example a corporate member could be the provider of much needed capital to a LLP, or it could be a provider of very specific services which could be of benefit to the LLP’s clients.

[edit] HMRC

HM Revenue & Customs (HMRC) however, view the existence of mixed partnerships rather differently and believe there is a significant loss to the exchequer through the use of such arrangements to avoid or, at the very least defer, the payment of tax and national insurance contributions (NICs).

So, with effect from April 2014 new legislation is being implemented which will have significant financial repercussions for any LLPs which have corporate members. In particular the new rules will target those corporate members who are controlled by or associated with individual members and which are allocated profit shares that are deemed 'excessive' by HMRC.

To understand this more fully some brief examples are provided:

[edit] Example A

UK Building LLP makes a profit of £200,000 to 31st March 2013 and has three members: Tom, John, and ABC limited. The profits are allocated equally to Tom and John (£100K each) and none to ABC Limited. In this scenario Tom and John will both pay around £34,200 in tax and National Insurance (based upon 2013 tax year parameters, and assuming the single person’s tax free allowance).

[edit] Example B

UK Building LLP makes a profit of £200,000 to 31st March 2013 and has three members: Tom, John, and ABC limited. In this example however, £80K of the profits are allocated equally to Tom and John (£40K each) and £120K to ABC Limited. In this scenario Tom and John will both pay around £9,000 in tax and National Insurance (based upon 2013 tax year parameters, and assuming the single person’s tax free allowance), and ABC Limited will pay £24,000 in corporation tax, assuming no deductible expenses within ABC Limited.

So the total tax take is £68,400 in Example A but only £42,000 in Example B

This simple analysis does not explain the whole story as further tax would be payable on income taken from ABC Limited either in the form of salary or dividends but in the event that no such income is taken or is deferred to a much later date, it is clear that there is a cash flow detriment to the Exchequer. At worst, there is a clear loss to the Exchequer in the event that when income is taken from ABC Limited it is taken by a standard rate taxpayer in lieu of the higher rate of tax being paid by John or Tom.

[edit] Changes implemented by the Finance Bill

HMRC are introducing revisions in the Finance Bill 2014 which will re-allocate 'excess' profits allocated to a non-individual member where the following conditions are met:

- A non-individual has a share of the firm’s profit.

- The non-individual’s share is excessive.

- An individual partner has the power to enjoy the non-individual’s share or there are deferred profit arrangements in place, and;

- It is reasonable to suppose that the whole or part of the non-individual’s share is attributable to that power or arrangements.

These proposals will affect all mixed partnerships regardless of their rationale. Those that have a sound commercial basis for their structure will be affected just as those which exist for tax saving purposes alone.

It is likely that many LLPs will opt to incorporate, but for those LLPs for whom this in neither desirable nor a viable option the matter of profit allocation with effect from April 2014 will become fraught with adverse consequences if these new rules are triggered.

This article was written by:--Martinc 12:35, 20 February 2014 (UTC)

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

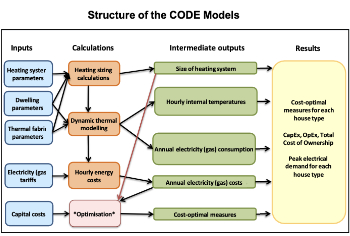

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.

Biomass harvested in cycles of less than ten years.

An interview with the new CIAT President

Usman Yaqub BSc (Hons) PCIAT MFPWS.

Cost benefit model report of building safety regime in Wales

Proposed policy option costs for design and construction stage of the new building safety regime in Wales.

Do you receive our free biweekly newsletter?

If not you can sign up to receive it in your mailbox here.