Forms of practice

To help develop this article, click 'Edit this article' above

Contents |

[edit] Introduction

There are three main types of practice:

- Sole trader

- Partnerships: traditional, limited partnership, limited liability partnership

- Limited company

[edit] Sole trader

- Trade in own name

- Easy setup

- No legal structure

- Responsible for yourself so face the risks alone

- High personal risk - personally liable

- Can cease to exist easily.

[edit] Partnerships

[edit] Traditional Partnership

- Relation between 2+ people in business for profit.

- Governed by 'Partnership act 1890'

- Easy to setup

- Not registered with companies house - no public disclosure of accounts

- Joint & several liability - personally responsible for each others errors

- Should have 'Partnership agreement'

- Deed of adherence - signed by incoming partners to agree with partnership agreement.

- Partners not a cost of business unless salaried.

- Profit taxed then distributed to partners.

- Pay NI.

- Audited.

[edit] Limited partnership

- 1+ general partner- operates partnership - liable for debts and obligations.

- 1+ limited partners with capital but no liability as not running firm.

- Registered at Companies house.

- No public disclosure of accounts.

- Often used for SPV ( special purpose vehicle).

- Should have 'Partnership agreement'

- Deed of adherence - signed by incoming partners to agree with partnership agreement.

- Partners not a cost of business unless salaried.

- profit taxed then distributed to partners.

- Pay NI.

- Audited.

[edit] Limited Liability Partnership (LLP)

- Trade in company name.

- All partners can participate in management.

- Partners liability limited to assets in firm - not affected personally.

- Registered at Companies House.

- Accounts publicly disclosed.

- Partners not a cost of business unless salaried.

- Profit taxed then distributed to partners.

- Pay NI.

- Audited

[edit] Limited liability company

- Directors.

- Owners are shareholders. minimum 1 shareholder

- Liability limited to value of shares.

- Banks/ landlords may seek personal guarantees as liability may be too low.

- Registered at Companies House.

- Public disclosure of accounts

- Articles of association + memorandum: forms companies constitution.

- Shareholders have control over board of directors.

- Profits taxed.

- Dividends taxed.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

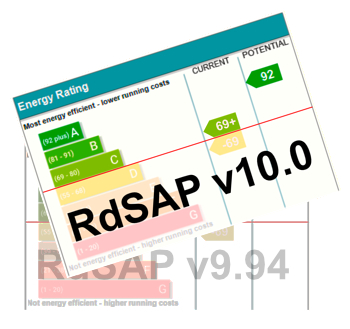

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

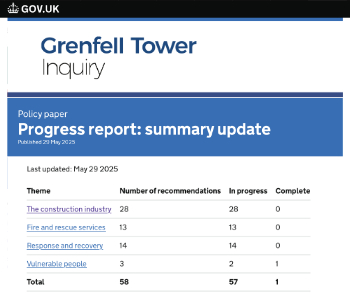

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.

Comments