Business Asset Disposal Relief BADR

Contents |

[edit] Introduction

Prior to 6 April 2020, Business Asset Disposal Relief (BADR) was known as Entrepreneurs’ Relief. The name was changed under the Finance Act 2020.

BADR is a source of capital gains tax (CGT) tax relief that supports entrepreneurs in their efforts to improve and invest in their businesses. It does this by reducing the amount of CGT on qualifying capital gains to 10% on the disposal of qualifying business assets on or after 6 April 2008.

BADR may be beneficial when the proceeds of the disposal of the asset would otherwise push the business owner into a higher tax band. Qualifying capital gains for each individual are subject to a lifetime limit as follows, for disposals on or after:

- 6 April 2008 to 5 April 2010, £1 million.

- 6 April 2010 to 22 June 2010, £2 million.

- 23 June 2010 to 5 April 2011, £5 million.

- 6 April 2011 to 10 March 2020, £10 million.

- 11 March 2020, £1 million.

[edit] Eligibility

BADR applies to qualifying disposals of business assets under:

- A sole trade and its assets.

- Partnership interests and assets.

- Shares in a self-owned company.

- Joint venture interests.

- Business assets held by a trust

In order to be eligible for BADR, the business owner must meet certain conditions throughout a two year qualifying period (either up to the date of disposal or the date the business ceased). The business owner must dispose of business assets within three years to qualify for relief.

BADR is available to CGT disposals made by individuals and some trustees of settlements, but it is not available to companies or in relation to a trust where the entire trust is a discretionary settlement. Personal representatives of deceased persons can only claim if the disposal took place whilst the deceased person was alive.

[edit] Making claims

Spouses or civil partners are separate individuals and may each make a claim. They are each entitled to BADR up to the maximum amount available for an individual, provided that they each satisfy the relevant conditions for relief.

BADR must be claimed, either by the individual or, in the case of trustees of settlements, jointly by the trustees and the qualifying beneficiary. The claim must be made to HMRC in writing by the first anniversary of the 31 of January following the end of the tax year in which the qualifying disposal takes place. A claim to BADR may be amended or revoked within the time limit for making a claim.

[edit] Related articles on Designing Buildings Wiki

- Capital gains tax.

- Finance Act.

- Rate relief schemes.

- Taxes associated with selling a business.

- Tax relief.

[edit] External resources

- Gov.uk, Capital Gains Manual.

Featured articles and news

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description fron the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

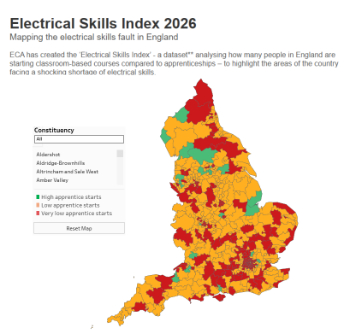

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

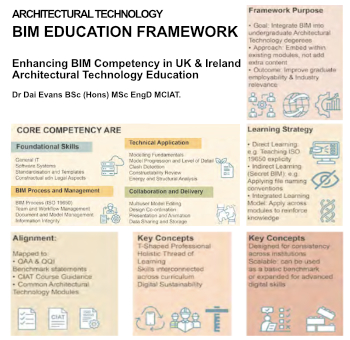

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.