Construction VAT

Contents |

[edit] Introduction

Value Added Tax (VAT) is a tax added to the cost of certain goods and services. It is only accountable where the party raising an invoice is VAT registered. It is necessary to register if VAT-able turnover exceeds a minimum threshold in any 12-month period.

When VAT is added to a sales invoice it is 'output tax' in the hands of the party raising the invoice. To the recipient of the invoice the same tax is 'input tax'.

Supplies of certain goods may be 'exempt' or 'zero-rated'. In both of these categories VAT is not added to the value of the supply but there is differing treatment with regard to input tax incurred with regard to making that supply.

In the design and construction sectors most supplies are 'standard-rated' and therefore VAT is added to the value of supplies at the prevailing rate of VAT. But certain types of work can sometimes be charged at a reduced rate, or at the zero rate (see the table below).

For a party wishing to undertake development of any sort it is vital that, in calculating the budget for the job, VAT is correctly accounted for:

- Are prices quoted inclusive or exclusive?

- Are you, the client, able to recover VAT or not?

- Is the work in question exempt from VAT or zero-rated?

If you run a VAT-registered construction business it is important to charge the right VAT rate. You can normally only charge the reduced or the zero rate if certain conditions are met. So if you think either rate applies, you should check the details to make sure.

The conditions can relate to different aspects of the work, including:

- The type of building worked on.

- The type of work you do and the equipment you instal.

- When you do the work.

- Who you do the work for.

Zero-rating and reduced-rating work on ordinary domestic dwellings

| TYPE OF WORK | VAT RATE |

| Construction of a new house or flat | zero |

| Converting a building into a house or flat | reduced rate |

| Renovating or altering an empty house or flat | reduced rate |

| Supplying and installing certain mobility aids for elderly people | reduced rate |

| Supplying and installing certain energy saving materials and equipment | reduced rate |

| Supplying and installing certain heating systems and security goods when funded by a grant | reduced rate |

| Connecting or reconnecting to the mains gas supply - first time connections and grant-funded connections or reconnections | Can sometimes be zero or reduced rate |

| Supplying or installing goods for a disabled person in their home | zero |

| Making alterations to suit a disabled person | zero |

| Converting a residential building into a different residential use - for example combining two cottages into a single house | reduced rate |

[Ref. HMRC: Work on ordinary homes that may be reduced-rated or zero-rated.]

Any construction work on an ordinary house or flat that isn't listed in the table above is always standard-rated at the current standard rate. This would include, for example:

- Building an extension, annex or granny annex.

- Converting a loft.

- Carrying out repairs or renovations.

[edit] Reverse charge

From March 2021, a domestic VAT reverse charge came into effect to tackle fraud in the construction industry. A reverse charge enables a customer to charge themselves VAT rather than the supplier charging it. This removes any opportunity for the supplier not to pay HMRC (missing trader fraud). The reverse charge applies to businesses that supply services to another business that will then sell on that service, but not those that supply services to consumers.

For more information see: VAT reverse charge.

[edit] Related articles on Designing Buildings Wiki

- Business rates.

- Capital gains tax.

- Construction invoice fraud.

- December 2020 GDP figures show construction vulnerable.

- Financial year.

- Hourly rate.

- PAYE.

- Stamp duty.

- Tax.

- Turnover.

- VAT - Option to tax (or to elect to waive exemption from VAT).

- VAT - Protected Buildings.

- VAT refunds on self-build homes.

- VAT reverse charge.

[edit] External references

- HMRC: Building and construction work and VAT.

- HMRC: Work on buildings other than ordinary homes that may be reduced-rated or zero-rated.

- HMRC: Work on ordinary homes that may be reduced-rated or zero-rated.

--Cantor Atkin 17:22, 28 Apr 2021 (BST)

Featured articles and news

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

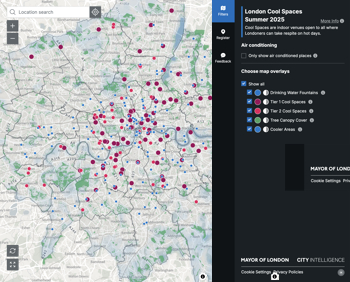

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Comments

Re: Construction of a new house or flat

I think it would be more accurate to say that "construction of most new houses and flats" is zero rated, as new separate self-contained dwellings can be liable to VAT if the terms of the planning permission prevent the separate disposal or separate use of the new dwelling. This is detailed in question 13 on tax form VAT431NB and its notes.

see https://www.gov.uk/government/publications/vat-refunds-for-diy-housebuilders-claim-form-for-new-houses-vat431nb