Construction Equipment Market Thrives on Urban Population Boom

[edit] Market growth and trend

The market growth in construction equipment between 2021 and 2030 is likely to be driven by rapid urbanisation around the world. The acceleration of urbanisation increases the demand for housing and propels further infrastructure investment. In recent years, the surging use of electric and fully autonomous equipment has become a key market trend. In addition, autonomous equipment increases the productivity of the construction sector, and offers greater site safety as well as addressing issues around skilled labour shortages.

The World Bank Group states that around 55% of the global population currently lives in cities. It is also estimated that the global urban population grew from 4.28 billion in 2019 to 4.358 billion in 2020. They also forecast that nearly 7 out of 10 people in the world will reside in urban areas, by 2050. The population growth in urban localities will result in the wide-scale construction of housing, as well as industrial, and commercial structures, increasing construction equipment demand.

[edit]

According to P&S Intelligence, within the product segment, the earth-moving machinery category is expected to account for the largest share in the construction equipment industry throughout this decade. The dominance of this category can be attributed to the improved grip offered by this construction equipment in poor conditions. The surging use of this machinery in the construction sector is also credited to its wide application bases, such as trench digging, demolition of structures, soil grading, laying foundations, and removing rocks and earth.

At present, the construction equipment industry is consolidated in nature, due to the presence of a few key players, such as Deere & Company, Volvo Construction Equipment, Caterpillar Inc., Doosan Infracore, Hitachi Construction Machinery, Sany Heavy Industry Co. Ltd., Liebherr AG, Joseph Cyril Bamford Excavators Ltd., Terex Corporation, and Liebherr AG.

Currently, these players are actively introducing new products to gain a competitive edge. For example, in April 2019, Volvo Construction Equipment announced its plan to introduce compact excavators (EC15 to EC27), and an electrically driven range of wheel loaders (L20 to L28). Likewise, in March 2020, Komatsu launched a new electric mini excavator, namely PC30E-5, in Japan to target the rental sector. This product delivers similar excavation performance compared to internal combustion models with similar power output while reducing vehicle noise and emitting no exhaust. Major players are focusing on launching autonomous equipment. For instance, D61i-24 and D51i-24 dozers of Komatsu Ltd. can record terrain data while manoeuvring through the site. This data helps make calculated decisions about materials used.

[edit] Concluding

Geographically, the APAC construction equipment market will generate the highest revenue in the foreseeable future. As construction projects are the backbone of economic development, a boom in the construction sector is a key contributor to the market growth in the region. Moreover, the growth of the sector in APAC is driven by mounting investments being made by governments in construction activities. Additionally, the rapid urbanisation in China, South Korea, India, and Japan will also drive the demand for construction equipment in these countries.

Featured articles and news

Licensing construction in the UK

As the latest report and proposal to licence builders reaches Parliament.

Building Safety Alliance golden thread guidance

Extensive excel checklist of information with guidance document freely accessible.

Fair Payment Code and other payment initiatives

For fair and late payments, need to work together to add value.

Pre-planning delivery programmes and delay penalties

Proposed for housebuilders in government reform: Speeding Up Build Out.

High street health: converting a building for healthcare uses

The benefits of health centres acting as new anchor sites in the high street.

The Remarkable Pinwill Sisters: from ‘lady woodcarvers’ to professionals. Book review.

Skills gap and investment returns on apprenticeships

ECA welcomes new reports from JTL Training and The Electrotechnical Skills Partnership.

Committee report criticises UK retrofit schemes

CIOB responds to UK’s Energy Security and Net Zero Committee report.

Design and construction industry podcasts

Professional development, practice, the pandemic, platforms and podcasts. Have we missed anything?

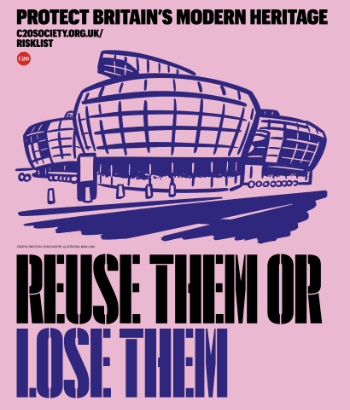

C20 Society; Buildings at Risk List 2025

10 more buildings published with updates on the past decade of buildings featured.

Boiler Upgrade Scheme and certifications consultation

Summary of government consultation, closing 11 June 2025.

Deputy editor of AT, Tim Fraser, discusses the newly formed society with its current chair, Chris Halligan MCIAT.

Barratt Lo-E passivhaus standard homes planned enmasse

With an initial 728 Lo-E homes across two sites and many more planned for the future.

Government urged to uphold Warm Homes commitment

ECA and industry bodies write to Government concerning its 13.2 billion Warm Homes manifesto commitment.

From project managers to rising stars, sustainability pioneers and more.

Places of Worship in Britain and Ireland, 1929-1990. Book review.

The emancipation of women in art.