Building automation systems market 2022-2031

The Building Automation Systems (BAS) market was valued at US $ 53.66 billion in 2016 and will grow between 2022 and 2031 at a CAGR of 10.73%, it is expected to reach US $ 99.11 billion by 2022. Factors such as increasing demand for energy-efficient systems, increasing needs for automation of security systems in buildings, and advances in IoT in BAS are expected to drive the growth of the BAS market as a whole. However, the high cost of implementation, technical difficulties, and lack of skilled professionals are factors that limit market growth.

The BAS market for security and access control systems is expected to grow at the fastest rate during the forecast period. The need to increase the level of security, activity monitoring, and access control has led to increased demand for security and access control systems. Demand for home security solutions is also growing rapidly due to a variety of factors, including technological advances, rising crime rates, the need for medical assistance to the elderly at home, and monitoring of children at home.

The Asia Pacific region is expected to be the fastest growing market for BAS. Markets in this region are subdivided into India, China, Japan and other Asia Pacific regions. Expected growth is due to the high economic growth witnessed by the major countries in the region. Rapid modernisation and increased construction activity in the APAC region has accelerated the growth of automatic centralised control of HVAC systems installed in the region, ultimately leading to the growth of APAC's BAS market. North America had the largest share of the BAS market in 2016. Commercial and residential applications have the largest share of the North American BAS market, and increasing demand for BAS and industrial applications for these applications is likely to stimulate the North American BAS market.

Extensive primary interviews with key industry players were conducted in the process of determining and validating the market size of several segments and sub-segments collected through the following surveys. The breakdown of the profile of the main participants is as follows:

- By company type: Tier 1 = 30%, Tier 2 = 40%, Tier 3 = 30%

- By designation: Executives = 30%, Manager = 35% , Other = 30%

- By Region: North America = 40%, Europe = 20%, APAC = 30%, Row = 10%

The major market players featured in the report are:

- Honeywell International, Inc. (USA)

- Siemens AG (Germany)

- Johnson Controls International PLC (Ireland)

- Schneider Electric SE (France)

- United Technologies Corporation (USA)

[edit] Related articles on Designing Buildings

- Artificial intelligence.

- Automated blinds.

- BACS building automation controls - the information revolution.

- Building energy efficiency - is building automation the answer?

- Building energy management systems BEMS.

- Building management systems.

- Commercial building automation market.

- Continental Automated Buildings Association CABA.

- Cyber threats to building automation and control systems.

- Energy management and building controls.

- Global building energy management systems market.

- Parking reservation systems.

- Smart building market projections through 2030.

- Smart buildings.

- US Smart Connected HVAC in Commercial Buildings Study 2017.

- Wireless vs wired building energy management system.

Featured articles and news

The challenge as PFI agreements come to an end

How construction deals with inherit assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

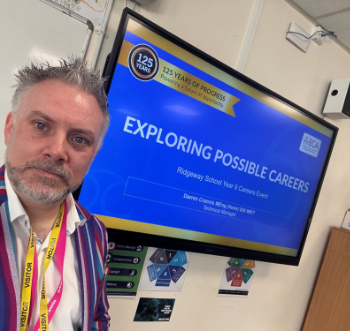

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.