Wuhan Guoyu Logistics Group Co Ltd & Anr v Emporiki Bank of Greece SA

Wuhan Guoyu Logistics Group Co Ltd & Anr v Emporiki Bank of Greece SA [2013] EWCA Civ 1679

This recent case provides yet another reminder of the court’s approach to and support for the enforcement of on-demand bonds and the harsh nature of these draconian forms of security.

In this case the defendant found itself having to honour payment under an on-demand bond despite the fact that it was called on an incorrect premise.

The facts concerned a shipbuilding contract between the buyer and Wuhan (‘the seller’) where the buyer agreed to provide a payment guarantee from its bank, Emporiki Bank, (‘the defendant’) to the seller, where the defendant guaranteed certain of the buyer’s payment obligations under the shipbuilding contract.

An earlier court judgment found that the payment guarantee was actually an on-demand bond.

The article Bonds and guarantees illustrates clearly that the name of the document can be misleading and does not necessarily accurately describe the nature of document; it is the content of the document that is key.

The seller demanded payment of an unpaid instalment from the buyer who refused to pay believing the instalment was not due. Consequently, the seller made a demand, in good faith, under the bond from the defendant for the unpaid instalment of the contract price. The defendant paid the money but a subsequent arbitration found that the instalment was not in fact due so the defendant argued that due to the mistake in making payment to the seller which was not owing, the monies paid under the bond should be held on trust for it.

The Court of Appeal rejected the defendant’s submissions finding that the monies were not held on trust for the defendant as this was not a case of mistake. It held that the bond was an autonomous contract, independent of the contract between the buyer and seller, so that when the seller made a call under the bond, monies were immediately payable as an enforceable cause of action had accrued against the defendant pursuant to the terms of the bond. As the judge stated: “....these principles underlie the basis upon which international trade is routinely financed....It is critical to the efficacy of these financial arrangements that as between beneficiary [the seller] and bank the position crystallises as at presentation of .....[the] demand...., and that it is only in the case of fraudulent .... demand by the beneficiary that the bank can resist payment against an apparently conforming ..... demand.”

Rewind to the previous article, Bonds and guarantees referred to above where it was noted that on-demand bonds are draconian in nature and do, generally, what they say on the tin: pay up on the demand of the beneficiary, except in the case of fraud. If it is at all possible to avoid giving such bonds, they should be resisted where alternative security is available, but in international trade and particularly in the middle east they are a preferred method of conducting business and assuring payment to clients concerned about defaulting contractors or consultants.

This article was created by construction lawyer --Najma Dunnett as part of an ongoing series of legal articles written for Designing Buildings Wiki. Follow Najma on Twitter to keep up to date with the latest changes in construction law @NDunnett_Cons.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Advance payment bond.

- Bonds and guarantees (Aviva Insurance Limited v Hackney Empire Limited 2012)

- Bonds in construction contracts

- Performance bond.

- Retention.

[edit] External references

Featured articles and news

Licensing construction in the UK

As the latest report and proposal to licence builders reaches Parliament.

Building Safety Alliance golden thread guidance

Extensive excel checklist of information with guidance document freely accessible.

Fair Payment Code and other payment initiatives

For fair and late payments, need to work together to add value.

Pre-planning delivery programmes and delay penalties

Proposed for housebuilders in government reform: Speeding Up Build Out.

High street health: converting a building for healthcare uses

The benefits of health centres acting as new anchor sites in the high street.

The Remarkable Pinwill Sisters: from ‘lady woodcarvers’ to professionals. Book review.

Skills gap and investment returns on apprenticeships

ECA welcomes new reports from JTL Training and The Electrotechnical Skills Partnership.

Committee report criticises UK retrofit schemes

CIOB responds to UK’s Energy Security and Net Zero Committee report.

Design and construction industry podcasts

Professional development, practice, the pandemic, platforms and podcasts. Have we missed anything?

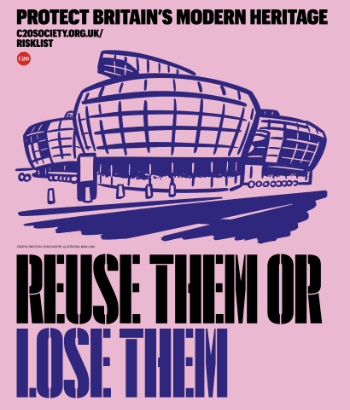

C20 Society; Buildings at Risk List 2025

10 more buildings published with updates on the past decade of buildings featured.

Boiler Upgrade Scheme and certifications consultation

Summary of government consultation, closing 11 June 2025.

Deputy editor of AT, Tim Fraser, discusses the newly formed society with its current chair, Chris Halligan MCIAT.

Barratt Lo-E passivhaus standard homes planned enmasse

With an initial 728 Lo-E homes across two sites and many more planned for the future.

Government urged to uphold Warm Homes commitment

ECA and industry bodies write to Government concerning its 13.2 billion Warm Homes manifesto commitment.

From project managers to rising stars, sustainability pioneers and more.

Places of Worship in Britain and Ireland, 1929-1990. Book review.

The emancipation of women in art.