The pros and cons of buying or leasing a property for your small business

To help develop this article, click 'Edit this article' above.

Contents |

[edit] Introduction

As an entrepreneur with a small business, your goal may be to expand. The more success you achieve, the larger your company grows. With that comes the decision of whether or not you should lease or purchase a property.

Committing to an space isn’t something that should be undertaken lightly. You need to carefully weigh up options in relation to what would benefit you as a business owner.

Here are some pros and cons that may help better inform your decision.

[edit] Purchasing a property

[edit] Pros

[edit] Potential to gain additional income

If you were to purchase a property that’s a bit bigger than you need, you can use the additional space to rent out. This way you have another source of income as well as the income from your continuously growing business.

[edit] Prices are fixed

Once you purchase a property, that’s it. There’s no risk of an unexpected rise in fees or additional pay-outs. You can then look to lock in your commercial mortgage for the business which will have structured and set payments that you can organise easily. This way you can focus more on your business.

[edit] Potential to sell on

If you take the time to invest in your property, it can provide a long-term gain when you choose to sell. There can be additional designs and features that you can add to the property and you have almost full control of the site and how you wish it to be changed. There’s just the little additional fee of hiring a conveyancing solicitor/ transfer of equity solicitors so that you’re able to have an easy process of transferring the property over.

[edit] Cons

[edit] The uncertainty of business growth

As mentioned earlier, you never know what the future holds for your business and unless you have a solid business plan in place anything could happen. You may be going really well and completely trust the idea of your business expanding greatly. In which case you may purchase a rather large property. There is then the risk that a commitment has been made too early and there’s the need to sell earlier than expected.

[edit] Costs to be paid upfront

When purchasing a property you’ll likely need to make a large investment beforehand which means you’ll need access to cash. There will be several costs including maintenance and property fees and any additional costs where there may be damages or potential to improve the property.

[edit] Leasing a property

[edit] Pros

[edit] Good locations

Many commercial landlords that rent out their property are in prime locations, which means that you’ll have a prime opportunity to target your audience easily. Retail parks are a good example where there are several businesses for customers to explore. It can also be far more affordable considering the potential business you’re likely to receive which can outweigh the rent costs.

[edit] Focus on business

Owning a property means you have additional worries to think about, including maintenance of the building and accommodating those around you. By renting a space it means that you can solely focus on your business.

[edit] Cons

[edit] Costs vary

As a business, your sole purpose is to make a profit and be efficient wherever you feel possible. However, leasing a property comes with unpredictability. The property owner can choose to increase rental fees when you least expect it and then when your rent comes up for renewal the fee may be larger than you may have thought it would be.

[edit] Equity

The fees that are contributed to the property will be funding the property owners business, which means you have less chance of making further income. By having your own space you’ll be able to gain additional income by renting out commercial space to others. If there were any problems with a tenant the cost of a dispute resolution solicitors will also need to be factored in.

[edit] Summary

These are the most important points you should consider when you’re deciding whether to lease or purchase your property. Most of it will be totally dependent on your business plan and the growth of the business. You may want to consider discussing the matter with the financial personnel in your business and seek advice about what the best option is for you.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

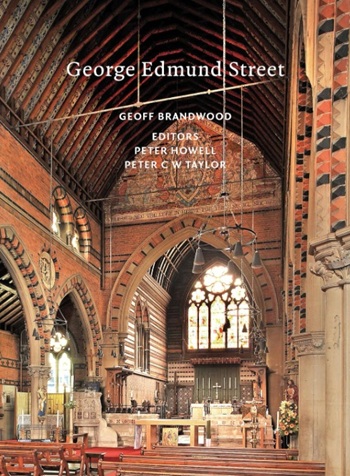

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

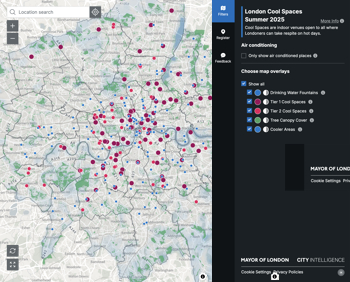

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.