Investment

Contents |

[edit] Introduction

Commercial investments are typically made with funds raised from investors (owners and lenders) in order to generate revenue. A business may an investment in equipment, premises, employees, stocks, and so on.

Investment involves making an outlay of something of economic value, usually capital, which is expected to yield economic benefits to the investor at some point in time. Typically, the outlay precedes the benefits (sometimes by a considerable time), and the outlay is one (or a small number of) large amount, whilst the benefits are derived in smaller amounts over a more protracted period.

Investment decisions are of important because of the resources involved, and the duration of the investment. They can also be very specific to the businesses needs, and so of little future value to others. For example, a construction company might invest in the building of a prefabrication factory to provide its projects with a flow of components. This factory may be difficult to sell on to another user because of its location, size, equipment, and so on. If the company decides that the investment has not recouped sufficient revenues, they may be forced to shut it down or sell at a loss.

[edit] Evaluation methods

Since investment decisions are very important, they should involve careful assessment of all options (including doing nothing). Some of the more commonly-used methods of evaluating investment opportunities are described briefly below:

[edit] Accounting rate of return (ARR)

This takes the average accounting profit that the investment will generate and expresses it as a percentage of the average investment in the project.

ARR = Average annual profit / Average investment to earn that profit x 100

[edit] Payback period (PP)

This is the length of time it takes for the initial investment to be repaid out of the net cash inflows resulting from the investment, taking into account annual depreciation. Projects that can recoup their costs quickly are economically more attractive than those with longer payback periods.

[edit] Net present value (NPV)

NPV represents the difference between the present value of cash inflows and the present value of cash outflows for an investment. For an investment to be worthwhile it has to yield a positive NPV, meaning that profit will be generated over time as a result of the investment.

For more information, see Net Present Value.

[edit] Internal rate of return (IRR)

IRR is a method of assessing a potential investment’s viability. Anticipated future income and expenditure are used to assess whether or not to proceed. The IRR is the percentage which, when applied to future capital costs and receipts, results in a Net Present Value of £Nil.

For more information, see Internal rate of return for property development.

[edit] Residual valuation

Residual valuation is the process of valuing land with development potential.

For more information see: Residual valuation.

[edit] Development appraisal

Development appraisal involves research into constraints and opportunities evolving from the location, legal and planning aspects of potential sites as well as their physical characteristics.

For more information see: Development appraisal.

[edit] Discounted cash flow

Discounted cash flow (DCF) is a technique for valuing a business in terms of its likely cash yields in the future. It is a form of analysis frequently used when purchasing a business.

For more information see: Discounted cash flow.

[edit] Related articles on Designing Buildings

- Accounting.

- Business plan.

- Cash flow.

- Company.

- Corporate finance.

- Development appraisal.

- Discounting.

- Discounted cash flow.

- Funding options for building developments.

- Gross development value.

- Investment decision maker.

- Long-term investment scenarios LTIS.

- Profit.

- Profitability.

- Quote.

- Residual value.

- Stakeholders.

- Yield.

[edit] External resources

- 'Accounting and Finance for non-specialists' (3rd ed.), ATRILL, P., & MCLANEY, E., Pearson Education (2001)

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

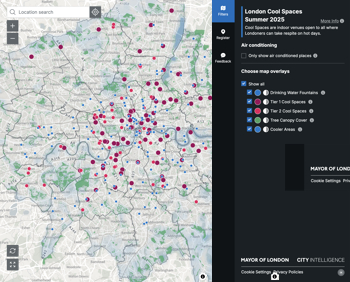

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).