Key Management as a Service Market Latest Trends, Opportunities, Key Players & Forecast Outlook

Key Management as a Service Market is expected to reach USD 2625.16 Million by 2027 growing at a 27.24% CAGR.

In this day and age, data has become more important. Information technology solutions are at an all-time high and are diversifying rapidly to address other unmet needs of the society. The development of key management as a service thus comes at a convenient time when managing sensitive data and login credentials is extremely important. It has become vital that data is safeguarded and kept secure from malicious and unlawful attempts to exploit it. Many organizations are turning to cloud service suppliers to resolve challenges, and the novel risks and additional responsibilities that come with key management as a service.

Key Management as a Service Market Key Players include:

- IBM Corporation (US)

- Amazon Web Services (US)

- Thales eSecurity (France)

- Oracle Corporation (US)

- Equinix Inc. (US)

- Alibaba (China)

- Egnyte (US)

- Ciphercloud (US)

- Google (US)

- Keynexus (US)

- Sepior ApS (Denmark)

- Unbound Tech (Israel)

- Box (US).

By component, the key management as a service market has been segmented into solution and services. The key management solutions segment is dominating the market due to the increasing adoption of key management solutions by enterprises to enhance their IT security and efficiency. Government initiatives supporting digitalization and increasing adoption of cloud services are the factors contributing to the growth of key management solution. Whereas, the service segment comprising professional and managed services, is projected to see high growth in the coming years. Lack of technical expertise and awareness among enterprises regarding key management solutions has driven the market in favour of key management service providers.

By application, the key management as a service market has been segmented into disk encryption, file encryption, database encryption, communication encryption, and cloud encryption. Among these, currently, the disk encryption application is expected to dominate the market due to the increasing demand among enterprises to reduce the risk of unauthorized access to sensitive information. Whereas, the cloud encryption segment is expected to see the fastest CAGR during the forecast period. Rising adoption of cloud platforms has driven the market for cloud encryption.

By organisation size, the market has been segmented into small- and medium-sized enterprises and large enterprises. Among these, the large enterprises segment is currently dominating the market due to the increasing need to safeguard huge volumes of sensitive information present on-premise as well as on cloud platforms. Also, large enterprises have a sufficient budget for IT spends to enhance their security and efficiency. SMEs are projected to grow with the fastest CAGR due to rising adoption of cloud-based platforms accelerating the demand for KMaaS.

By vertical, the market has been segmented into BFSI, healthcare, IT and telecommunication, government, retail, manufacturing, and aerospace, and defense among others. Among these, BFSI is currently dominating the market due to the high demand for information security. Increasing adoption of digital and cloud technology across BFSI sectors are some of the prime factors driving the adoption of key management as a service among banking and financial institutions. The healthcare vertical is projected to grow at the fastest CAGR during the forecast period.

Featured articles and news

Investors in People: CIOB achieves gold

Reflecting a commitment to employees and members.

Scratching beneath the surface; a guide to selection.

ECA 2024 Apprentice of the Year Award

Entries open for submission until May 31.

UK gov apprenticeship funding from April 2024

Brief summary the policy paper updated in March.

For the World Autism Awareness Month of April.

70+ experts appointed to public sector fire safety framework

The Fire Safety (FS2) Framework from LHC Procurement.

Project and programme management codes of practice

CIOB publications for built environment professionals.

The ECA Industry Awards 2024 now open !

Recognising the best in the electrotechnical industry.

Sustainable development concepts decade by decade.

The regenerative structural engineer

A call for design that will repair the natural world.

Buildings that mimic the restorative aspects found in nature.

CIAT publishes Principal Designer Competency Framework

For those considering applying for registration as a PD.

BSRIA Building Reg's guidance: The second staircase

An overview focusing on aspects which most affect the building services industry.

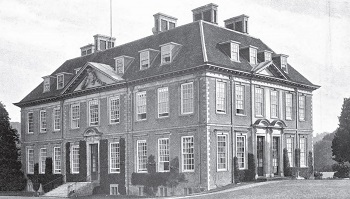

Design codes and pattern books

Harmonious proportions and golden sections.

Introducing or next Guest Editor Arun Baybars

Practising architect and design panel review member.

Quick summary by size, shape, test, material, use or bonding..