VAT refunds on self-build homes

Self-build homes and the conversion of non-residential buildings into dwellings may qualify to reclaim the VAT paid on eligible building materials and services. The building must not be intended to be used for business purposes.

The refund applies whether the home owner carries out the building work themselves, or whether they use builders to do some, or all of the work for them. Refunds are also permitted where the home owner adds to or finishes a partly completed new building, but not for extra work carried out on a completed building.

Claims to HMRC can only be made once the construction is finished. Completion can be demonstrated by:

- A certificate or letter of completion from the local authority for building regulations purposes.

- A habitation certificate or letter from the local authority.

- A valuation rating or council tax assessment.

- A certificate from a bank or building society.

Claims must be made within three months of completion and refunds will normally be made within 30 banking days of receiving the claim.

Making a claim requires that VAT invoices have been obtained and that they are correct. VAT invoices must show:

- The supplier's VAT registration number.

- The quantity and description of the goods and/or services.

- The purchaser’s name and address if the value is more than £100.

- The price of each item.

It is much easier to collect, collate and process the appropriate paperwork as project progresses than it is to try to do so after the building is complete.

Claims can be made for:

- Building materials or goods incorporated into the building or conversion itself, or into the site (that is materials or goods that cannot be removed without using tools and damaging the building or the goods themselves). Exceptions include; fitted furniture, some electrical and gas appliances, and carpets or garden ornaments.

- If you are converting a non-residential building into a home, you can reclaim the VAT charged by your builder. For conversions, a builder can sometimes charge you a reduced rate instead of the standard rate of VAT.

Builder's services for new buildings should be zero-rated for VAT.

VAT paid on any professional or supervisory services cannot be reclaimed (although in kit houses this may be wrapped-up in the price of the kit), neither can VAT paid on services such as the hire of plant, tools and equipment.

[edit] Related articles on Designing Buildings Wiki

- Business rates.

- Kit house.

- PAYE.

- Self build.

- Self-build home project plan.

- Self-build homes negotiating discounts.

- Self build initiative.

- Stamp duty.

- VAT

- VAT - Option to tax (or to elect to waive exemption from VAT).

- VAT - Protected Buildings.

[edit] External references

Featured articles and news

CIOB Construction Manager of the Year 2025

Just one of the winners at the CIOB Awards 2025.

Call for independent National Grenfell oversight mechanism

MHCLG share findings of Building Safety Inquiry in letter to Secretary of State and Minister for Building Safety.

The Architectural Technology Awards

AT Awards now open for this the sixth decade of CIAT.

50th Golden anniversary ECA Edmundson awards

Deadline for submissions Friday 30 May 2025.

The benefits of precast, off-site foundation systems

Top ten benefits of this notable innovation.

Encouraging individuals to take action saving water at home, work, and in their communities.

Takes a community to support mental health and wellbeing

The why of becoming a Mental Health Instructor explained.

Mental health awareness week 13-18 May

The theme is communities, they can provide a sense of belonging, safety, support in hard times, and a sense purpose.

Mental health support on the rise but workers still struggling

CIOB Understanding Mental Health in the Built Environment 2025 shows.

Design and construction material libraries

Material, sample, product or detail libraries a key component of any architectural design practice.

Construction Products Reform Green Paper and Consultation

Still time to respond as consultation closes on 21 May 2025.

Resilient façade systems for smog reduction in Shanghai

A technical approach using computer simulation and analysis of solar radiation, wind patterns, and ventilation.

Digital technology, transformation and cybersecurity

Supporting SMEs through Digitalisation in Construction.

Villa Wolf in Gubin, history and reconstruction. Book review.

Construction contract awards down one billion pounds

Decline over the past two months compared to the same period last year, follows the positive start to the year.

Editor's broadbrush view on forms of electrical heating in context.

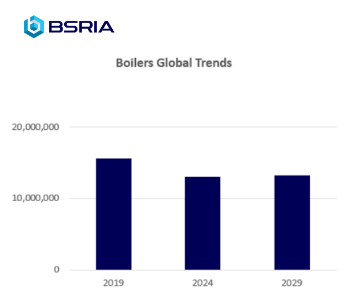

The pace of heating change; BSRIA market intelligence

Electric Dreams, Boiler Realities.

New President of ECA announced

Ruth Devine MBE becomes the 112th President of the Electrical Contractors Association.