UK Construction contract spending up 69 percent at the start of 2025

UK Construction contract spending is up 69% in the first month of the new year of 2025.

- Positive news following a bleak purchasing managers’ index (PMI Index) report in early February

- New construction orders reached nearly 8.4bn in January

- Residential contracts up £900billion on December

- Infrastructure projects remain a key comment in 2025 predictions

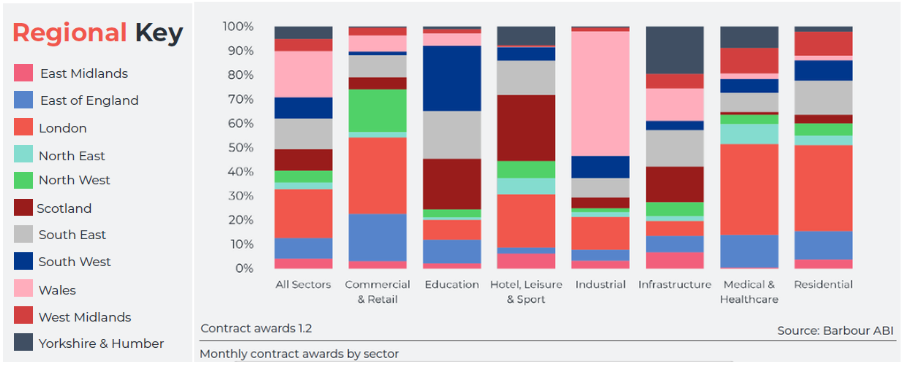

Spending on new construction orders reached nearly 8.4bn in January in an upbeat start to the year for construction – a 69% increase on December. The analysis follows analysis in the last month of the year from Barbour ABI that contract awards were up 15% up in 2024.

The figures provide a silver lining after the S&P Global purchasing managers’ index (PMI) showed a fall in on-the-ground construction output in January.

The residential sector bounced back from a disappointing finish to 2024 to see a January total of just under £2.5bn, up £900million on previous month. A £180million development at Devonshire Garden in Cambridge led the surge with Morgan Sindall set to carry out the works.

Meanwhile infrastructure awards were up 7% on previous month and 13% on same month last year. The renewable energy sector played a role including contracts awarded at Immingham Green Energy Terminal at a cost of £170m.

“A great start to the year with contract awards augurs well for 2025,” said Barbour ABI Head of Business and Client Analytics, Ed Griffiths. “This suggests that the downturn highlighted in the recent PMI index could be short-lived, with new work on the horizon.

“A further fall in interest rates announced this week will also add to increased confidence from investors, although the news is tempered by a fall in projected UK GDP. Although growth is expected for 2025 it will be at the lower end in the built environment.”

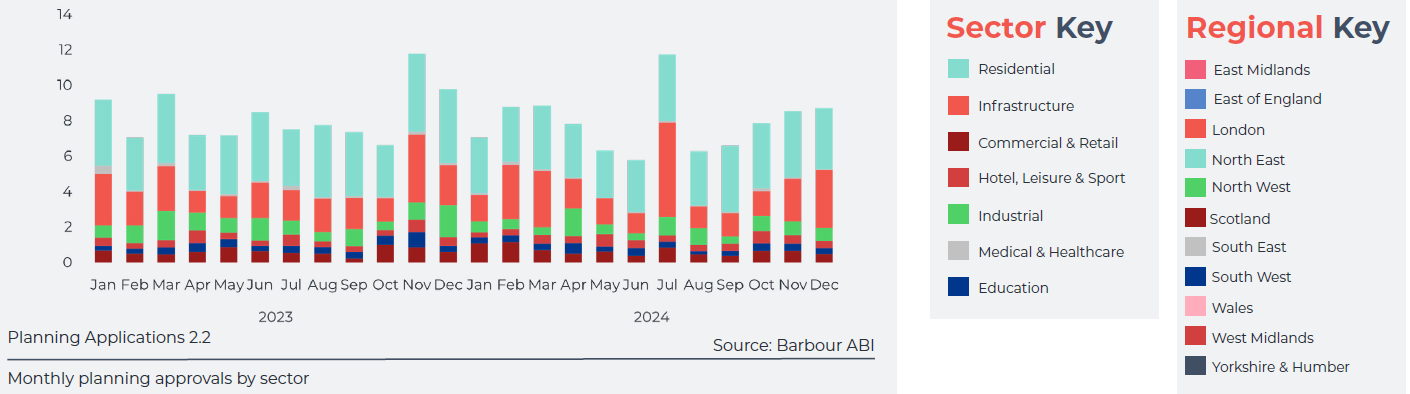

Meanwhile the latest planning application figures remained flat with a 2% increase between November and December 2024. Although there was little movement overall, individual sectors did see significant rise and falls.

December was a strong month for the infrastructure sector with a 35% increase in the value of applications. The top application was the 840MW Botley West Solar Project. The North East saw a strong recovery from a weak November rising to £540m. The largest application was a 1000MW Battery Storage Project.

“Our recent industry performance review highlighted how infrastructure sustained the sector in 2024. Planning applications at year-end suggest this trend could continue into 2025, with green energy at the forefront,” said Griffiths.

“However, uncertainty remains high, and the industry will be hoping that falling interest rates finally lead to an increase in project submissions.”

[edit] Related articles on Designing Buildings

- Construction contract awards provide relief in the wake of ISG collapse

- Construction contract awards jump to £7.3bn in May as uncertainty continues

- Construction industry revs engines in January

- Election fails to spark construction industry revival

- Government construction and infrastructure pipelines.

- Green infrastructure.

- Growth and Infrastructure Act.

- Homeowners turn to green energy upgrades as home improvement activity declines

- Infrastructure and Projects Authority.

- Infrastructure UK (IUK).

- Infrastructure nationalisation.

- Infrastructure tumbles, adding to construction industry woes

- London construction cools as hotspots appear nationally

- London infrastructure plan.

- National Infrastructure Pipeline.

- National Infrastructure Plan.

- Nationally Significant Infrastructure Projects.

- New energy rules, a threat to towns and cities across UK

- Planning approvals increased by 20% in June ahead of Labour’s new drive for housebuilding

- Residential takes the reins from infrastructure as contract awards even out

- Resilience of UK infrastructure and climate predictions.

- Smart cities.

- Subdued planning environment figures provide scant hope for house-building targets

- The future of green infrastructure.

- Traffic and transport.

Featured articles and news

Managing building safety risks

Across an existing residential portfolio, a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.