UandI Preliminary results Feb 2017

On 26 April 2017, regeneration and development firm U+I reported preliminary results for the year ended 28 February 2017.

The headlines included:

- Four new large-scale PPP projects were won, adding £90m to the pipeline of gains from 2020 and £1.5bn of gross development value to the portfolio.

- Two specialist platforms were established – joint ventures with Proprium Capital Partners and Colony NorthStar to leverage equity and intellectual capital and generate fees.

- Investment portfolio values stabilised.

- £18.0m of non-core investment asset disposals in line with the strategy to reposition the investment portfolio and drive higher returns.

- £35m of development and trading gains were realised.

- £65m - £70m of development and trading gains set to be delivered in FY2018 and visibility on more than £150m of development and trading gains in the next three years from existing projects alone.

- Investment portfolio total return of 10% targeted for FY2018 through non-core asset disposals (FY2018 target: £50m), reinvestment (FY2018 target: £50m) and asset management (FY2018 target: £5m).

- Targeting a £2m reduction in net recurring overheads in FY2018 through cost savings and management fees from specialist platforms.

- The business is on track to deliver a 12% post tax total return per annum in the next three years.

Matthew Weiner, Chief Executive said:

"I am encouraged by our performance. We delivered £35 million of development and trading gains from our planning-led regeneration activities, notwithstanding the substantial hit to transaction activity following the EU referendum. This result, which was within our guidance range, has enabled us to declare a third consecutive supplemental dividend in addition to our ordinary dividend. In the year ahead, we are set to deliver our highest level of development and trading gains to date - £65-70 million - from a mix of large-scale public private partnership (PPP) projects and shorter-term trading opportunities, delivering our target 12% post-tax return to shareholders.

“We have made good progress on our strategy. During the year, we secured four significant PPP projects totalling £1.5 billion of gross development value and adding £90 million of development and trading gains in FY2020 and beyond. This reflects our stated focus on large-scale PPP regeneration opportunities and underlines our leading reputation in this market. We were pleased to establish two specialist platforms during the year with Proprium Capital Partners and Colony NorthStar. These platforms allow us to acquire and deliver projects off-balance sheet, in line with our equity efficient approach, leveraging our equity and intellectual capital whilst generating fees to the business to offset overhead.

“Improving the performance of our investment portfolio remains a key priority. We are focused on delivering a 10% total return from our investment activities in the year ahead as we transition our portfolio to better align to our core regeneration expertise. We are targeting £100 million of transactional activity this year with £18 million already in hand, and are set to deliver £5 million of value gain as a result of our proactive asset management.

“The potential in the UK for mixed-use regeneration is significant and the number of opportunities is growing. Based on our extensive expertise in planning and development, we are confident that we can deliver sustainable returns to shareholders as we create long lasting social and economic change for the communities in which we work."

For more information, see U+I's report.

--U and I

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

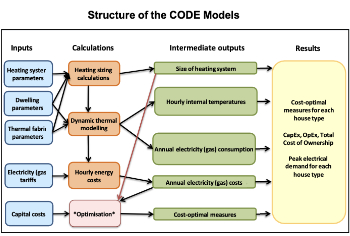

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.

Biomass harvested in cycles of less than ten years.

An interview with the new CIAT President

Usman Yaqub BSc (Hons) PCIAT MFPWS.

Cost benefit model report of building safety regime in Wales

Proposed policy option costs for design and construction stage of the new building safety regime in Wales.

Do you receive our free biweekly newsletter?

If not you can sign up to receive it in your mailbox here.