How to Register for the Construction Industry Scheme (CIS)

The Construction Industry Scheme (CIS) is a mandatory tax deduction scheme designed by HMRC for contractors and subcontractors working in the UK construction sector. Whether you're just starting out as a sole trader or running a growing construction business, registering for CIS can offer numerous benefits – including smoother tax management and enhanced credibility with clients.

In this guide, we’ll break down the steps you need to follow to register for CIS and why professional support can make all the difference.

Contents |

[edit] What is the Construction Industry Scheme (CIS)?

CIS was introduced by HM Revenue and Customs (HMRC) to combat tax evasion in the construction industry. Under the scheme, contractors deduct money from a subcontractor’s payments and pass it directly to HMRC as advance payments towards the subcontractor’s tax and National Insurance.

CIS applies to:

- Self-employed workers

- Partnerships

- Limited companies

- Labour agencies and property developers working in construction

Failing to register for CIS can lead to higher tax deductions (30% instead of the standard 20%) and penalties from HMRC.

[edit] Why Should You Register for CIS?

Registering for CIS ensures that:

- You get paid with lower tax deductions (20% instead of 30%)

- You maintain HMRC compliance

- You improve your business reputation and increase your chances of winning contracts

Plus, with CIS registration, you can reclaim certain business expenses and potentially receive tax refunds if you’ve overpaid.

[edit] Step-by-Step: How to Register for CIS

[edit] 1. Set Up as Self-Employed (If You Haven’t Already)

If you’re a subcontractor and not yet registered as self-employed, your first step is to register for Self Assessment with HMRC. Need help? Get expert guidance from a professional.

[edit] 2. Register for CIS as a Subcontractor or Contractor

- Subcontractors: You’ll need your UTR (Unique Taxpayer Reference), National Insurance number, and legal business name.

- Contractors: You'll also need to verify your subcontractors and submit monthly CIS returns.

You can register by:

- Logging into your HMRC online services account

- Calling the CIS helpline if needed

- Or let a professional handle the paperwork

[edit] 3. Maintain Compliance

After registering:

- Contractors must file monthly CIS returns

- Subcontractors must ensure accurate records and invoices

- Everyone must stay updated with CIS payment statements and tax obligations

[edit] Get Expert Help for Hassle-Free CIS Registration

Registering for CIS might sound straightforward, but missing a step or providing incorrect information can result in delays, penalties, or excessive tax deductions.

That’s where experts come in with

- Full support with CIS registration

- Ongoing CIS returns management

- Help with self-assessment filing

- Guidance on how to claim back overpaid tax

Save time, avoid HMRC fines, and ensure everything is handled correctly from the start. Find a CIS specialist today.

[edit] Final Thoughts

Joining the Construction Industry Scheme is a smart move for anyone working in UK construction — whether you're a solo subcontractor or managing a team of workers. Registering not only keeps you HMRC compliant but also helps you manage your cash flow better.

Featured articles and news

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

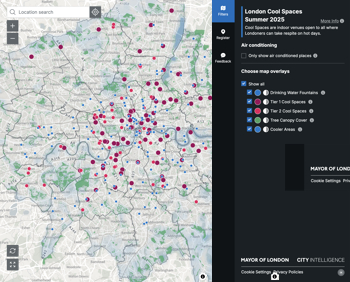

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).

Ebenezer Howard: inventor of the garden city. Book review.

Airtightness Topic Guide BSRIA TG 27/2025

Explaining the basics of airtightness, what it is, why it's important, when it's required and how it's carried out.