How to Register for the Construction Industry Scheme (CIS)

The Construction Industry Scheme (CIS) is a mandatory tax deduction scheme designed by HMRC for contractors and subcontractors working in the UK construction sector. Whether you're just starting out as a sole trader or running a growing construction business, registering for CIS can offer numerous benefits – including smoother tax management and enhanced credibility with clients.

In this guide, we’ll break down the steps you need to follow to register for CIS and why professional support can make all the difference.

Contents |

[edit] What is the Construction Industry Scheme (CIS)?

CIS was introduced by HM Revenue and Customs (HMRC) to combat tax evasion in the construction industry. Under the scheme, contractors deduct money from a subcontractor’s payments and pass it directly to HMRC as advance payments towards the subcontractor’s tax and National Insurance.

CIS applies to:

- Self-employed workers

- Partnerships

- Limited companies

- Labour agencies and property developers working in construction

Failing to register for CIS can lead to higher tax deductions (30% instead of the standard 20%) and penalties from HMRC.

[edit] Why Should You Register for CIS?

Registering for CIS ensures that:

- You get paid with lower tax deductions (20% instead of 30%)

- You maintain HMRC compliance

- You improve your business reputation and increase your chances of winning contracts

Plus, with CIS registration, you can reclaim certain business expenses and potentially receive tax refunds if you’ve overpaid.

[edit] Step-by-Step: How to Register for CIS

[edit] 1. Set Up as Self-Employed (If You Haven’t Already)

If you’re a subcontractor and not yet registered as self-employed, your first step is to register for Self Assessment with HMRC. Need help? Get expert guidance from a professional.

[edit] 2. Register for CIS as a Subcontractor or Contractor

- Subcontractors: You’ll need your UTR (Unique Taxpayer Reference), National Insurance number, and legal business name.

- Contractors: You'll also need to verify your subcontractors and submit monthly CIS returns.

You can register by:

- Logging into your HMRC online services account

- Calling the CIS helpline if needed

- Or let a professional handle the paperwork

[edit] 3. Maintain Compliance

After registering:

- Contractors must file monthly CIS returns

- Subcontractors must ensure accurate records and invoices

- Everyone must stay updated with CIS payment statements and tax obligations

[edit] Get Expert Help for Hassle-Free CIS Registration

Registering for CIS might sound straightforward, but missing a step or providing incorrect information can result in delays, penalties, or excessive tax deductions.

That’s where experts come in with

- Full support with CIS registration

- Ongoing CIS returns management

- Help with self-assessment filing

- Guidance on how to claim back overpaid tax

Save time, avoid HMRC fines, and ensure everything is handled correctly from the start. Find a CIS specialist today.

[edit] Final Thoughts

Joining the Construction Industry Scheme is a smart move for anyone working in UK construction — whether you're a solo subcontractor or managing a team of workers. Registering not only keeps you HMRC compliant but also helps you manage your cash flow better.

Featured articles and news

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

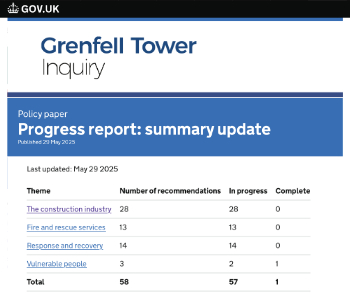

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.