EMEA compressor market 2020 - 2023

|

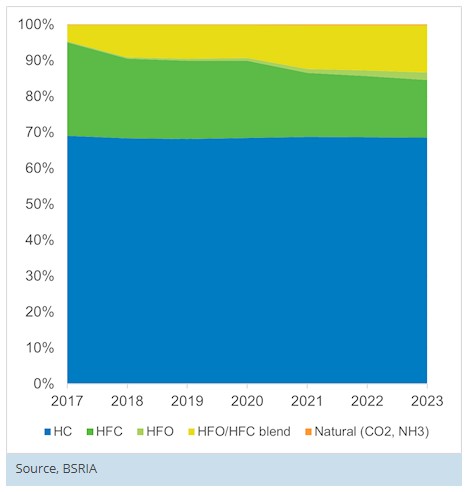

| Penetration of refrigerants by type, % of units, 2017 - 2023. |

Contents |

[edit] Introduction

In March 2021, BSRIA plans to publish a study on compressors used in three key applications: air conditioning (or comfort cooling), heat pumps for space and water heating and refrigeration. The study provides insight into changes in technologies and refrigerants. (This includes stationary applications only.)

[edit] Expanding markets

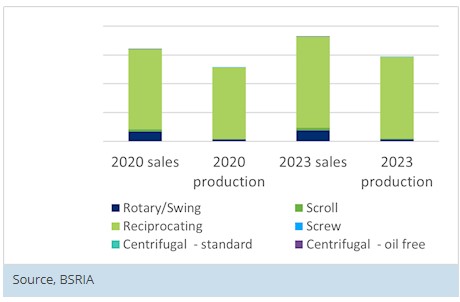

With the rapid growth taking place in the residential AC market in EMEA (Europe, the Middle East and Africa), sales of rotary compressors are expected to surge. In addition, more suppliers of domestic AC products have set up manufacturing in Europe and the Middle East to encourage proximity with their distributors. This will strengthen the market base for both rotary and scroll compressors used in AC units.

While recent years have seen demand for smaller capacity units in EU countries, sales of splits and other AC units in the commercial sector are expected to falter, as high-street retailers suffer from the double blow of COVID-19 and the growth of e-commerce, which is set to continue.

Above a certain threshold of 250-300 kW, screw compressors are largely used in chillers. Centrifugal oil-free compressors compete with screw but their use is more limited, due to their cost premium.

|

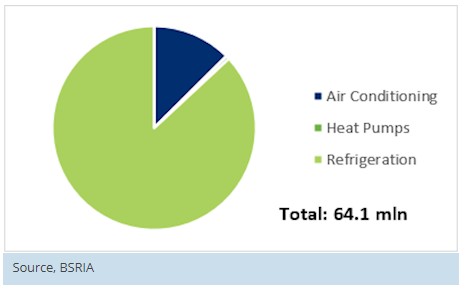

| HAC&R compressors by application, by volume (million units), 2020. |

[edit] Heat pumps

Despite the impact of COVID-19 and the lockdown imposed in EMEA countries, the heat pump market in 2020 held up remarkably well and registered growth. Heat pumps are surfing on a wave of legislation and other drivers for the decarbonisation of buildings, in particular of heating systems.

For those heat pumps that are entirely manufactured in EMEA, this encourages the market for rotary compressors in capacities up to 10 kW and scroll compressors in the range above. Screw compressors are also used in units sold for large industrial applications including district heating, starting at about 200 kW capacity and reaching above 2 MW.

|

| Sales vs production of HAC&R compressors by type, by volume (units), 2020 and 2023. |

The refrigeration sector is a key market for compressors in EMEA, as there are several very important suppliers of refrigeration units operating in the region. It accounts for a significant share of compressors, in particular for reciprocating types. In the long run, scroll compressors are not expected to take market share from semi-hermetic reciprocating, as they are not able to handle the same breadth of applications and refrigerant types.

[edit] Refrigeration

The refrigeration sector is going towards a general reduction of energy required for food conservation. Energy saving has been pushed by legislation in several countries, in particular the European Union, where directives such as Ecodesign and Ecolabel, which are under revision, have driven the uptake of electronic speed variation in compressor motors.

In EMEA, refrigerants are following the general trend of a shift towards alternatives with lower global warming potential, and the European Union is at the forefront of this move. While the AC industry is operating the move towards R32, which is a stopgap rather than a long-term solution, other refrigerants for large compressors operating at lower pressure include pure HFO such as R1234ze. CO2 or hydrocarbons such as propane (R290) remain limited to specific products and climates.

While the majority of the domestic HP market is still using R410A, there are more initiatives towards using propane in outdoor units for HP than in AC. In addition, the use of R1234ze in large screw units, with its large temperature range, allows for a growth in the market for commercial heat pumps.

Finally, while the domestic refrigeration market is dominated by isobutane (R600a), in commercial applications the use of R404A faltered when HFO/HFC blends became available. While CO2 has become widespread in compressor racks for supermarkets (and propane in plug-in refrigerated display cases), it is expected that HFO blends with low GWP will benefit from the phase out of R404A.

This article originally appeared on the BSRIA website with the headline, 'EMEA Compressor market set to recover in line with OEM markets despite COVID-19 setback'. It was published in February 2021.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

The Home Energy Model and its wrappers

From SAP to HEM, EPC for MEES and FHS assessment wrappers.

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.