Sand blasting machines

Robotic blasting technology has seen wide acceptance where standard automation solutions do not meet the needs of complexity, process requirements or quality control. In addition, manual sand blasting has potential health hazards.

Inhalation of silica may lead to health issues including silicosis and other lung diseases. Other abrasive materials including water, crushed glass, walnut shells, and so on, have gained prominence due to government regulations in many nations prohibiting the use of blast cleaning abrasives comprising more than 0.1% free silica. Shot blasting machines are gaining popularity as they use metallic shots and grits as abrasives.

Industries such as; aerospace, consumer electronics, automotive, medical, and so on have adopted robotic blast systems for applications such as; material removal, coating removal, surface preparation, shot peening, mold cleaning, and stress relief. Growing demand from these sectors is anticipated to boost market growth, and applications such as 3D printing offering a carved or handmade look have also started adopting the new technology.

The sand blasting machines market size is forecast to hit USD 485 million, growing at 3.5% by 2022. The market has enjoyed a substantial surge due to increased use in industrial and domestic applications. Increased expenditure in this new technology by the key market participants is likely to drive market growth in the near future, and robotic sandblasting technology is expected to open new avenues for the market.

The mini sand blasting machines market share is projected to exceed USD 90 million, growing at a CAGR of more than 4% and will lead the application segment in coming years due to their inherently portable nature and use in household tasks.

The industrial sand blasting machines market is projected to be worth USD 390 million during this time frame. The trend for replacing manual labour is likely to drive further growth by 2022.

The demand in Asia Pacific market is anticipated to dominate due to the Chinese market together with increasing use in the infrastructure, construction, and automotive sectors. Europe is expected to reach USD 95 million by 2022, with gains estimated at 2.5% during the forecast period.

The extremely fragmented market features; Airblast B.V, Kramer Industries, Sintokogio Group, Clemco Industries Corp, Norton Sandblasting Equipment, Midwest Finishing Systems Inc., Torbo Engineering Keizers GmbH and SANdBOT (JetSystem Group).

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Homes England supports Greencore Homes

42 new build affordable sustainable homes in Oxfordshire.

Zero carbon social housing: unlocking brownfield potential

Seven ZEDpod strategies for brownfield housing success.

CIOB report; a blueprint for SDGs and the built environment

Pairing the Sustainable Development Goals with projects.

Types, tests, standards and fires relating to external cladding

Brief descriptions with an extensive list of fires for review.

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

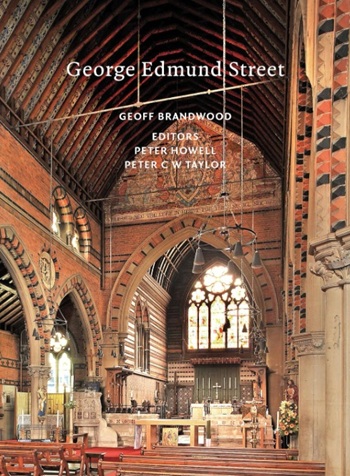

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.