Modified bitumen

The global modified bitumen market was valued at USD 13.22 Billion in 2015 and is projected to reach USD 19.29 Billion by 2021, growing at a CAGR of 6.5%. Road construction is projected to growth at the highest rate during the forecast period.

The use of modified bitumen has increased in road and building construction in the Asia-Pacific and the Middle East & Africa regions, due to the growing awareness of benefits such as low maintenance cost and efficiency. Modified bitumen is used for road construction which includes tunnel liners, bridges and flyovers, highways, and airport runways, where high material performances is required.

The Styrene-Butadiene-Styrene (SBS) segment is estimated to be the largest segment of the, by modifier type, in terms of value and volume. SBS is a premier modifier used for road construction in places with heavy traffic to reduce low temperature thermal stress cracking, abrasion, deformation, flushing, and to provide high tensile strength. SBS modified bitumen and Atactic Polypropylene (APP) modified bitumen are commonly applied by the hot asphalt method.

Asia-Pacific is the largest market for modified bitumen, in terms of volume, followed by Europe and North America. China, U.S., Germany, Canada and Mexico. End-use industries, such as road and building construction represent the bulk of the demand for modified bitumen in the Asia-Pacific region. Rising awareness about the benefits of modified bitumen has driven demand in Asia-Pacific countries, such as China, Japan, and India.

The key players in the global modified bitumen market include Sika AG (Switzerland), Nynas AB (Sweden), Total S.A. (France), Royal Dutch Shell Plc (Netherlands), and Colas S.A. (France).

Featured articles and news

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

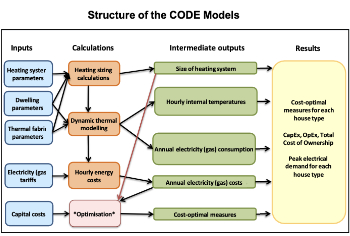

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.