Global boiler market 2016-2017

[edit] 2017 market

Driven by environmental policies uptake and increasing gasification in Asia Pacific, the domestic boiler market grew in 2017 to 15 million units, with China recording the most 'dynamic market uptake'.

Socrates Christidis, Senior Market Intelligence Analyst, BSRIA’s World Market Intelligence Division, said:

“The Chinese market, driven by the accelerated effect of the ‘coal to gas’ policy, is now by far the largest global market with over 4.6 million boilers sold in 2017. The Chinese market is dominated by wall mounted gas non-condensing boilers that accounted for 90% of the market in 2017.

"However, despite South Korea recording a moderate decline in 2017, it is now the second largest market with just under 1.7 million boilers sold. With an 86% share, wall-mounted boilers also accounted for the majority of the market, the 57% share of non-condensing units is lower than in China.

"The boiler market in South Korea is quite mature; further positive prospects until 2022 are based on replacement with condensing technology but are also limited due to the low growth rate of population, residential construction market and economy.”

UK has recorded sales of 1.6 million units in 2017 remaining in third position in the list of largest markets in 2017. With over 26 million boilers installed, there is a large replacement market where almost 100% of units sold are of gas condensing type.

In 2017, the other countries to record markets of over one million domestic units were Turkey and Russia, while the North American market remains a low consumer of domestic boilers with around 400,000 units sold per annum.

In the commercial boiler market China is again the largest market with just over 109,100 units sold in 2017, with the North American (55,500) market being the second and Turkey (50,100) the third largest market.

While China is expected to post a fair growth of 5% in the next five years, higher growth rates of between 5.8% and 6.8% are expected in North America, Turkey and Russia. European commercial boiler markets are more under pressure with under 150 kW wall-mounted boilers more likely to grow.

[edit] 2016 market

Driven by environmental policy uptake and increasing gasification in Asia the domestic boiler market grew in 2016 to 12.7 million units, with China recording the most dynamic market uptake.

The growth in the China and South Korea markets resulted in the UK no longer being the largest world market for domestic boilers, now just the third largest according to the latest BSRIA market intelligence study published in July 2017.

The Chinese market, driven by the roll out of the 'coal to gas' policy, is now the largest global market with more than 1.77 million boilers sold in 2016 and further dynamic growth expected until 2021. The Chinese market is dominated by wall mounted gas non-condensing boilers, which accounted for 87% of the market in 2016.

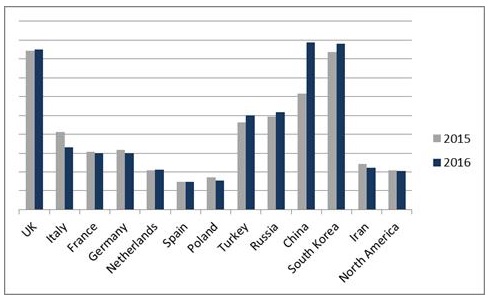

[Graph: Yearly sales of domestic boilers by country - CAGR 2016 in EU: -1%, CAGR 2020 outside EU: 17%.]

South Korea also recorded good growth in 2016, becoming the second largest market with more than 1.75 million boilers sold, and further growth prospects until 2021. With a 76% share, wall-mounted boilers accounted for the majority of the market. The share of non-condensing units is however lower than in China, with condensing technology advancing continually.

The UK recorded sales of 1.7 million units in 2016, placing it third in the list of largest markets in 2016. With more than 26 million boilers installed, there is a large replacement market, in which almost 100% of units sold are of the gas condensing type.

The other countries with markets of more than 1 million domestic units were Turkey and Russia, whilst the North American market remains a low consumer of domestic boilers with around 400,000 units sold a year.

In the commercial boiler market China is again the largest market with more than 92,500 units sold in 2016, with the North American market was the second largest and Turkey the third largest market. While China is expected to post a fair growth of over 2% in the next few years, the highest growth rate (6.6%) is expected in Russia.

European commercial boiler markets are under pressure with floor standing boilers experiencing particular difficulties.

This article was originally published here in July 2017 and here in July 2018 by BSRIA.

--BSRIA

[edit] Related articles on Designing Buildings

- 2021 UK HVAC trends: winners and losers.

- BSRIA articles on Designing Buildings Wiki.

- Biomass boiler.

- Boiler.

- Boiler markets and the green recovery.

- Building heating systems.

- Condensing boiler.

- Domestic boiler market 2019.

- European decarbonisation and heating technologies beyond 2021.

- Global study of challenges and opportunities in the BACS market.

- Industrial gas boilers market 2020.

- Radiator.

- Thermal comfort.

- Types of domestic boiler.

Featured articles and news

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.