Global Membrane Separation Market Research

Persistence Market Research Released New Market Report on “Global Market Study on Membrane Separation: Water & Waste Water Segment to Witness Highest Growth by 2019”.

The global membrane separation market was valued at USD 19.0 billion in 2012 and is expected to grow at a CAGR of 10.8% from 2013 to 2019, to reach an estimated value of USD 39.2 billion in 2019.

Mandatory government regulation and increasing demand for clean processed drinking water is propelling the water processing industry to provide the public with clean processed drinking water free of impurities. This is providing growth opportunities for the water treatment industry.

Mandatory adherence to environmental standards such as the Clean Water Act especially in areas with water scarcity have influenced the demand for better water treatment technology, including membrane separation technology. Shifting from chemical to physical treatments is also a major driver as chemical treatments are perceived as environmentally unclean technologies with associated disposal costs. In addition, awareness of water scarcity has influenced the demand for water reuse in water stressed areas.

Worldwide industrial expansion and growing population are propelling the demand for better water treatment technology, providing growth opportunities for the global market for membrane separation technology. Additionally, the oil and petroleum industry is well established in the gulf and European countries such as Italy and Germany which use membrane separation technology for liquid separation. Expansion of such industries is expected to increase the overall demand for membrane separation technology.

Membrane separation technology is bifurcated into four major processes, microfiltration, ultrafiltration, nanofiltration and reverse osmosis. Microfiltration dominates the market with more than 35% of the global market share in 2012. Whereas water and wastewater dominates the end-user market with 36% of the global market shares in 2012. The global membrane separation market grew from USD 19.0 billion in 2010 to USD 21.2 billion in 2013.

The european membrane market (the largest in 2013) is expected to reach USD 13.8 billion in 2019, growing at a CAGR of 9.6%. In 2012 the water and wastewater sector was the major end-user of membrane separation technology and this is expected to increase at a CAGR of 11.1% during 2013-19.

The membrane separation market is fragmented with several players in the market supplying membrane separation products to the end-users (water and wastewater, industrial and healthcare) in the market. Most of the companies produce different types of membrane products such as microfiltration, nanofiltration, ultrafiltration and reverse osmosis and sell them globally.

Major companies operating globally and manufacturing all four products are Evoqua Water Technologies, Pall Corporation, Koch Membrane Systems Inc., Merck Millipore, Degremont SA, Dow Chemical Company, GEA Filtration, 3M Company, Nitto Denko Corporation and Veolia Environnement.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

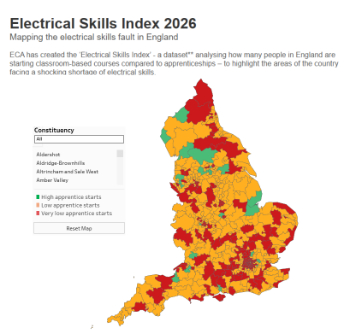

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.