Financial management glossary

Contents |

[edit] Working capital

- Working capital is the everyday working money available to run the business.

- Current assets - current liabilities = working capital.

- The amount of working capital required can be reduced by accelerating the rate at which money circulates through the business (for example prompt billing).

For more information see: Working capital

[edit] Working capital turnover rate

- Total annual fee income / average value working capital = working capital turnover rate.

[edit] Profit and loss account

- Annual statement of income and expenditure that shows if a company has made an overall gain on trading performance.

For more information see:Profit and loss account

[edit] Balance sheet

- A picture of the business as it stands, providing a statement of total assets and liabilities at a given point in time (usually the year end).

For more information see: Balance sheet

[edit] Monthly 'flash' profit & loss report

Actual vs budget information based on:

- Net Income (after paying others) (work in progress not included).

- Resources.

- Overheads.

- Gives an indication which area might be responsible for a loss or profit.

- Useful over a longer period of time to spot trends and blips.

[edit] Key performance indicators (KPI's)

Liquidity KPI's (liquid assets=cash):

- Analyses ability to pay bills as they become due.

- Current ratio = current assets (including work in progress) / current liabilities.

- Quick ratio (acid test) - quick assets (cash+bank balance+debts) / current liabilities'

- Ratios over 1 are deemed satisfactory. The higher the better.

Financial Performance plan:

For more information see: Key performance indicators

[edit] Project resource plan

- Shows hours of each grade of person required monthly.

- Hours translated into cost x by rate per hour of each grade.

- Projected fees vs projected cost - plotted on graph.

- Compare projected with actual to monitor performance.

- Share information to give a sense of involvement and responsibility. This will allow them to align their actions with the best interests of the company.

[edit] Fee forecasting

Fee forecasting is crucial to running a business as it allows the future financial position to be assessed and ensures that records of potential fees are maintained.

Captive fee forecasting:

- Fees are agreed, fully documented, contractually binding and scheduled for current projects.

- An indicator of how busy a company is likely to be in short to medium term.

- Avoid the cliff edge - when a project is delivered fees reduce so it is important to win more work to maintain cash-flow through fees.

Future possible fee forecasting:

- All possible fees hoped to be earned. Anything but certain.

- Quantify probability of winning them with a success probability factor %.

- The aim is to attempt to predict the medium to long term.

Resources forecast:

- Establish whether the right number of people are available to deliver the work lined up in the captive fees forecast.

- Keep a rolling weekly forecast of people required vs people available.

- Plan for flexibility so there is always some resource available for general work.

- It is most efficient to use those with recent experience on similar projects to achieve good results quickly.

For more information see: Fee forecasting.

[edit] Cashflow forecasting

- Cashflow = total money in and out of a business affecting liquidity.

- The most accurate way of predicting the financial health of a company in the short - medium term.

- Gives an idea of when cash shortage problems may be approaching.

- Rolling 6 monthly.

- If seeking a loan / overdraft, a 2/3 year forecast may be needed.

[edit] Credit Control

- Good organisation is the key to good credit control.

- Invoice for fees in a regular and determined way.

- Chase up when they are not paid on time.

- Agree payment terms.

- Keep a record of all correspondence regarding fees.

- Logged in aged debtor report - all outstanding payments and for how long.

- Understand clients payment systems.

- Outstanding invoices should be chased

- Remind them of agreed terms in invoices.

- If over due send reminder email with copy of invoice.

- Further 1 or 2 weeks… phone call.

- Last resort: Dispute resolution.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

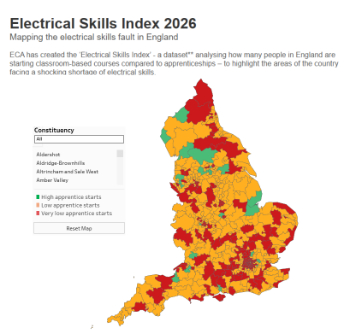

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.