Thermal spray coating

The aerospace and power generation industries are actively focusing on the development of advanced surface coating processes. The presence of hexavalent chromium and environmental issues related to it has caused a number of end-use industries to look for alternatives. As a result, thermal spray coatings have gained traction as a replacement for hard chromium plating in the aerospace industry.

Thermal spray coatings are also used in medical implants. Increasing use of titanium and hydroxyapatite coatings in biomedical implants using thermal spray technology, is expected to drive the growth of the market. However, thermal spray coating is a line-of-sight coating process, i.e. it covers only the part which is in a line of the coating system. Moreover, robotic functions and frequent adjustments in case of complex geometries lead to high costs, which is expected to inhibit the growth of the market.

Global sales of thermal spray coatings are expected to beUS$ 7.6 Bn by the end of 2016, witnessing a year-on-year growth of 5.6% compared to 2015. North America and Europe are expected to account for more than 50% of the global thermal spray coatings market by the end of 2016 and are anticipated to remain dominant.

By material type, ceramics are expected to continue to dominate the market in terms of value. This segment is also expected to witness high growth. Metals, alloys, and carbides are expected to account for more than 50% of the market by the end of 2016.

On the basis of process type, hte cold spray segment is expected to expand at double-digit CAGR in terms of value. This is mainly because it is suitable for depositing a wide range materials on various types of substrate, especially those that are temperature sensitive.

On the basis of application, aerospace is expected to account for a market value share of 37.4%, valued at US$ 4.7 Bn by the end of 2024. Industrial gas turbines are expected to expand at the highest CAGR in terms of value as a result of increasing energy requirements across the globe. This, in turn, is projected to fuel demand for thermal spray coatings, as this process provides excellent coatings and exhibits superior resistance to wearing and corrosion.

Sales of thermal spray coatings in North America are estimated to account for highest share by the end of 2016. Sales in the Asia Pacific are expected to increase at the highest CAGR.

Key players in the global thermal spray coatings market include Sulzer Ltd., Oerlikon Group, Praxiar Ltd., Bodycote plc., Abakan Inc., Curtis-Wright Corporation, Metallisation Ltd., Thermal Spray Technologies Inc., and ASB Industries, Inc. The thermal spray coatings market has witnessed various merger and acquisition activities, leading to industry consolidation over the last few years. Most of these activities were undertaken by market leaders in North America and Europe markets.

The long-term outlook for the global thermal spray coatings market remains positive,with the Cold spray and High-Velocity Oxy-fuel (HVOF) segments expected to expand at highest CAGRs.

Featured articles and news

The Building Safety Forum at the Installershow 2025

With speakers confirmed for 24 June as part of Building Safety Week.

The UK’s largest air pollution campaign.

Future Homes Standard, now includes solar, but what else?

Will the new standard, due to in the Autumn, go far enough in terms of performance ?

BSRIA Briefing: Cleaner Air, Better tomorrow

A look back at issues relating to inside and outside air quality, discussed during the BSRIA briefing in 2023.

Restoring Abbotsford's hothouse

Bringing the writer Walter Scott's garden to life.

Reflections on the spending review with CIAT.

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

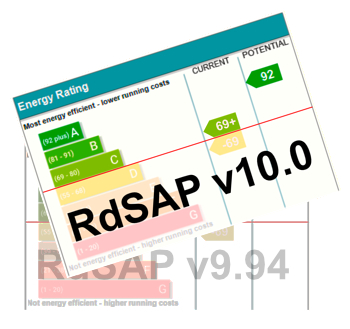

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.