Run-off cover for professional indemnity insurance

Professional indemnity insurance (PII), sometimes known as errors and omissions insurance (E&O), provides insurance cover against claims of negligence. It is widely used where professional services are being provided to a developer or contractor, and will provide insurance up to a specified insured sum where negligence is proven to have been committed on the part of the service provider.

Professional indemnity insurance is generally provided on a 'claims-made' basis, meaning that insurance must be held when the claim is made, rather than when the incident occurred.

Run-off cover is a form of professional indemnity insurance that applies when a business, or individual stops operating in a particular field. This might be because the business has been sold, it has changed direction, it has gone into administration, an individual has retired, and so on.

The fact that at form of practice has comes to an end, does not necessarily mean that the possibility of claims has come to an end. Claims can arise for years after projects have been completed, and it is important that practitioners maintain PII for as long as such a risk exists. Run-off cover provides continuing indemnity to cover costs that are associated with a claim.

As the likelihood of a claim reduces as time progresses, so the cost of a run-off policy generally reduces year on year, although, some insurers offer run-off policies payable with a one-off premium as this can reduce the uncertainty of ongoing payments.

The nature of the work that has been undertaken will be an important factor in determining the length of time before a claim is likely to arise. From the date a problem occurs, the statute of limitations holds that a business or individual can be sued for up to six years. Therefore, a minimum of six years run-off cover is generally recommended, although businesses sometimes opt for a shorter period as they may judge that claims are likely to be made earlier rather than later.

NB Insurance Policyholder Taxation Manual, published by HM Revenue & Customs on 19 March 2016, defines run-off as: ‘the continuing liability of an insurers in respect of a block of past business, for example where a reinsurance contract has been terminated but a liability remains in respect of risks or cessions accepted during the period of the agreement, or where an insurer has ceased to accept new business but has not settled all outstanding claims arising on old business.’

[edit] Related articles on Designing Buildings

Featured articles and news

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

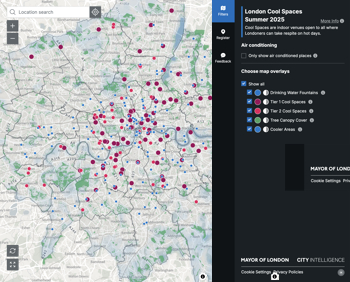

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).

Ebenezer Howard: inventor of the garden city. Book review.

Airtightness Topic Guide BSRIA TG 27/2025

Explaining the basics of airtightness, what it is, why it's important, when it's required and how it's carried out.

Comments

[edit] To make a comment about this article, or to suggest changes, click 'Add a comment' above. Separate your comments from any existing comments by inserting a horizontal line.