Climate Change Levy

The Climate Change Levy (CCL) was introduced in the UK by the 2000 Finance Bill and came into force on April 1 2001. It is a tax on energy use intended to promote energy efficiency and to encourage investment in energy saving equipment. It was originally suggested that it would reduce carbon dioxide emissions by at least 5 million tonnes by 2010 as part of the UK government’s strategy for meeting its commitments under the Kyoto Protocol.

For the purposes of the Levy, energy use refers to electricity, gas, liquid petroleum gas and solid fuel. The CCL is charged by energy suppliers on behalf of the government from most businesses and public sector bodies that pay VAT at the standard rate. Domestic and charitable non-business energy use is exempt from the CCL, as is energy from some renewable sources and combined heat and power (CHP). There are also partial exemptions for energy intensive users and horticulture users. Ofgem administers the exemption certification scheme for renewable sources and combined heat and power on behalf of HMRC.

There are two rates of Climate Change Levy:

- The main rates of CCL.

- The Carbon Price Support (CPS) rates of CCL.

The main rates of CCL are charged on the supply of specified energy products for use as fuels. The CPS rates are charged on the supply of specified energy products for use in electricity generation (Ref HMRC, Climate Change Levy - introduction to the two rates of CCL).

In the 2016 budget, it was announced the Carbon Reduction Commitment energy efficiency

scheme would be abolished and replaced, in a revenue neutral way, with an increase in the Climate Change Levy from 2019. This it was said was because the scheme had been 'bureaucratic and burdensome'.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

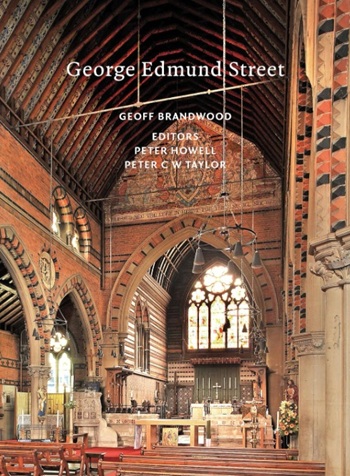

One of the most impressive Victorian architects. Book review.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

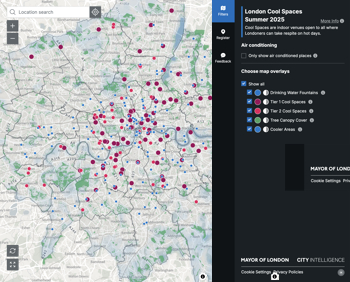

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.