About

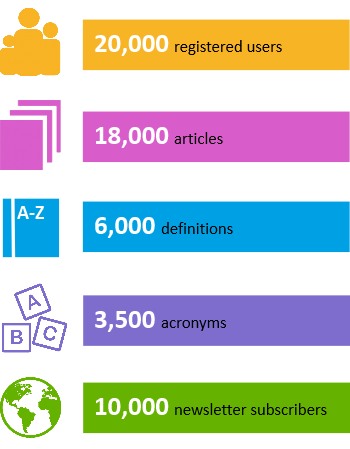

Designing Buildings is the construction wiki. An industry-wide, cross-discipline forum for finding and sharing knowledge about the planning, design, construction and operation of built assets.

Write an article

You can write about any subject related to the construction industry, including research, publications, organisations, theories, news, products and practices. All we ask is that articles are factual (not adverts) and are encyclopaedic in style (not blog posts).

Designing Buildings has 25 knowledge hubs where you can find introductions to our main subject areas and links to key articles that will help you learn more

The site also includes 6 microsites - mini wikis about specialist subjects. Created with our partners, they provide easy access to curated knowledge about particular aspects of the built environment:

Features and news

The challenge as PFI agreements come to an end

How construction deals with inherit assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Around the web

Research to support the circular economy in Scotland’s built environment.

Andrew Eldred appointed Managing Director of ECA.

Open consultation: Home Energy Model: Energy Performance Certificates.

IHBC welcomes RICHeS full access fund call, open to 8 April.

The Conflict Avoidance Process (CAP).

Consultation on proposed geographies over which spatial development strategies should be produced.

Why Electrical Contractors Should Review It Now.

Chartered week, 23-27 February

Celebrating Trusted Professionals.

Planning Act provisions come into force, enabling fee surcharges and nature recovery plans.

Jennie Daly CBE appointed Chair of the Future Homes Hub.

UKGBC launches framework to accelerate a nature-positive built environment.

Construction Management, 13 Feb

Zane’s Law will clean up Britain’s contaminated land legacy.

FPA launches fully digital Fire & Risk Management journal.

WATER: Resilience & Innovation for the Built Environment.

Bursaries for IHBC Newcastle 2026 open to 13/04, submit now to be next on the list!

An open repository of construction details to build with low-carbon materials.

A Look Back in Time.. at 125 years.

LG23 Design, creativity and compliance guide.