Scottish Building Safety Levy: consultation on proposals

The Scottish Government are seeking views on the introduction of a new tax - the Building Safety Levy - in Scotland. This levy would take the form of an additional charge on new residential development, to be paid by housebuilders. Revenue raised from this levy would support the Scottish Government's work to remediate cladding in existing residential buildings.

The Scottish Government are seeking views on the introduction of a new tax - the Building Safety Levy - in Scotland. This levy would take the form of an additional charge on new residential development, to be paid by housebuilders. Revenue raised from this levy would support the Scottish Government's work to remediate cladding in existing residential buildings.

The questions in this consultation are grouped into the following sections:

- the principles of introducing a Levy on new housebuilding, to support cladding remediation work.

- the scope of the Levy - who should pay, and who should be exempt

- how the Levy should be calculated

- how the Levy should operate - when will it be charged, and how will it be collected.

- compliance - what kind of powers might be needed to enforce the Levy

- duration - how long the Levy should run for; and

- impacts - how housebuilders and the wider housing supply chain might be affected by the introduction of the Levy

Responses to this consultation and the associated programme of engagement will support the policy development for a potential future Building Safety Levy in Scotland. If the powers to allow Scottish Ministers to introduce a building safety levy are devolved to the Scottish Parliament, then responses will also support development of a future Bill that provides for a devolved tax.

Read the consultation paper. The consultation paper contains full background information for this consultation. You may find it useful to read or refer to while responding.

A Partial Business and Regulatory Impact Assessment (BRIA) has also been published, which provides our initial view of the costs, benefits and risks that the Scottish Building Safety Levy may have if introduced.

This article appears on the Scottish Government website as 'Scottish Building Safety Levy: consultation on proposals' dated 23 Sept, 2024.

[edit] Related articles on Designing Buildings

- ACM cladding.

- Barnett consequentials and the Barnett guarantee.

- EWS1.

- Barnett consequentials and the Barnett guarantee

- Grenfell Tower articles.

- Grenfell Tower.

- Hackitt Review.

- High-rise building.

- HPL cladding.

- Material of limited combustibility.

- Non-ACM cladding.

- Rainscreen cladding.

- Residential Property Developer Tax.

- Scottish Building Safety Levy.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings for people to come home to... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

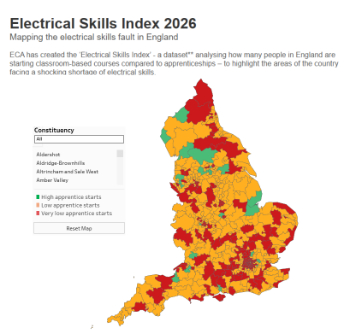

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

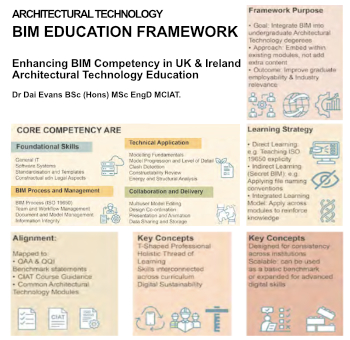

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”