Research and development tax relief

Research and development tax relief is a specialist piece of tax relief made available by governments to provide incentives to businesses. It is designed to provide support to companies who invest in research and development (R&D), to help bring new products to market, to develop new processes, or to improve existing products or processes.

R&D tax relief should be considered at the start of a project as it can have a significant impact on costs and the budget and may even make an unfeasible project, feasible. Tax relief mechanisms may vary widely in different countries and for different periods of time, so should be checked based on location and year of application.

This article is aimed primarily at companies operating in the UK, there are similar schemes in many EU countries. In the 2023 spring budget the UK Government made a number of significant changes to the mechanisms relating to Research and Development tax relief, in particular with respect to small and medium enterprises (SME's)

There are two schemes available to UK companies, an SME Scheme, aimed at Small to Medium Sized Companies, (SME R&D relief) and a large company scheme for companies that do not meet the criteria of the SME Scheme referred to as Research and Development Expenditure Credit (RDEC).

To qualify for the SME Scheme the following criteria need to be met:

- Less than 500 staff

- A turnover of under 100 million euros or a balance sheet total under 86 million euros

Partner and linked enterprises, may also need to be included when assessing if the company is an SME, but the SME R&D relief allows companies to:

- Deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction

- Claim a tax credit if the company is loss making, worth up to 14.5% of the surrenderable loss

To get R&D relief a project needs to explain how it;

- looked for an advance in science and technology

- had to overcome uncertainty

- tried to overcome this uncertainty

- could not be easily worked out by a professional in the field

The project may research or develop a new process, product or service or improve on an existing one.

Any company that does meet the criteria of the SME Scheme is eligible to claim under the Large Company Scheme.

The Research and Development Expenditure Credit is a tax credit, it was 11% of qualifying R&D expenditure up to 31 December 2017 and was increased to:

- 12% from 1 January 2018 to 31 March 2020

- 13% from 1 April 2020

SMEs and large companies who have been subcontracted to do R&D work by a large company can also claim under the schemes.

In September 2020, HM Revenue & Customs reported that £175m was paid to UK construction firms in research and development tax credits in the previous year,a significant increase on the £90m paid the year before.

[edit] Related articles on Designing Buildings

Featured articles and news

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

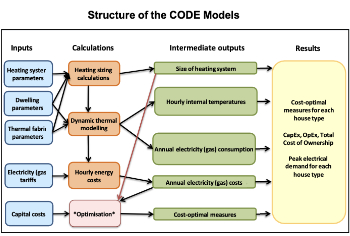

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.

Biomass harvested in cycles of less than ten years.

An interview with the new CIAT President

Usman Yaqub BSc (Hons) PCIAT MFPWS.

Cost benefit model report of building safety regime in Wales

Proposed policy option costs for design and construction stage of the new building safety regime in Wales.

Do you receive our free biweekly newsletter?

If not you can sign up to receive it in your mailbox here.