Financial management tools

Contents |

[edit] Financial planning

Financial planning develops from strategic plans and business plans to identify the financial resources that are needed by a business and to obtain and develop those resources to achieve the business' goals. Typically, financial planning generates relevant and realistic budgets.

[edit] Managing cash flow

One of the most important financial statements for a business is the cash flow statement. The overall purpose of managing cash flow is to make sure that a business has enough cash to pay current bills. Businesses can manage cash flow by examining a cash flow statement and cash flow projection (or cash flow forecast). In essence, the cash flow statement presents total cash received minus total cash spent.

[edit] Budgeting and managing a budget

A budget presents what a business expects to spend (expenses) and earn (revenue) over a specific time period. Budgets are useful for planning finances and then tracking whether the business is operating according to plan. They are also useful for projecting how much money will be needed for business initiatives, for example, buying new equipment, hiring new employees, and so on.

There are yearly (operating) budgets, project budgets, cash budgets, etc. The overall format of a budget is a record of planned income and planned expenses for a fixed period of time.

[edit] Budget deviation analysis

Budget deviation analysis regularly compares what the business expected, or planned to earn and spend with what it actually spent and earned. A budget deviation analysis can help assess how closely a business is following its plans, how much to budget in the future, where there may be upcoming problems in spending, and so on.

[edit] Credit and collections

One of the biggest challenges in managing cash flow can be decisions about granting credit to customers or clients, and how to collect payment from them.

[edit] Managing cash flow tools

Cash flow is the movement of income into and expenditure out of a business over time.

The establishment and maintenance of a robust financial system that projects, monitors and regulates the financial success of a business is essential. It is critical to agree a cash flow to an agreed programme:

- Set an annual budget of income, expenditure and profit before the beginning of each financial year and then use this to monitor/control expenditure in the practice.

- Monthly forecasting - this can be used to spot trends and to predict shortfalls in workload and to appropriately allocate resources.

- Weekly monitoring - time sheets for staff members can be used so that performance can be measured in both cost and time.

- Daily monitoring - records for fee invoices paid, suppliers' invoices settles, fee invoices raised, petty cash utilised.

- Other reports - annual audited accounts, VAT returns and bank reports.

- Cash Collection Report - create a full report every month of invoices rendered and when they are/were due for payment. After submitting invoices, send reminders for accounts that have not been settled on time. A number of acceptable debtor days should be agreed, over which more severe action will be taken to recover money due.

- Establish financial budgeting and reporting by project - graph reporting can highlight projected fee, actual fee and actual costs.

[edit] Related articles on Designing Buildings Wiki

- Budget

- Business case.

- Business plan

- Cashflow.

- Cash flow forecast.

- Construction loan.

- Construction Supply Chain Payment Charter.

- Fair payment practices for construction.

- Financial hedging.

- Housing Grants, Construction and Regeneration Act.

- Remedies for late payment.

- Scheme for Construction Contracts.

- The Late Payment of Commercial Debts Regulations 2013.

Featured articles and news

The UK’s largest air pollution campaign.

Future Homes Standard, now includes solar, but what else?

Will the new standard, due to in the Autumn, go far enough in terms of performance ?

BSRIA Briefing: Cleaner Air, Better tomorrow

A look back at issues relating to inside and outside air quality, discussed during the BSRIA briefing in 2023.

Restoring Abbotsford's hothouse

Bringing the writer Walter Scott's garden to life.

Reflections on the spending review with CIAT.

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

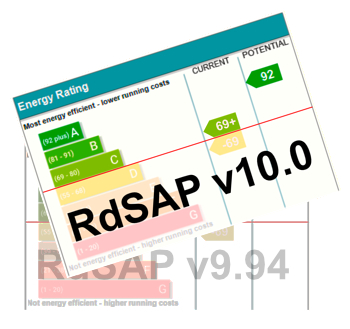

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.