Global cabling market 2019

Contents |

[edit] Introduction

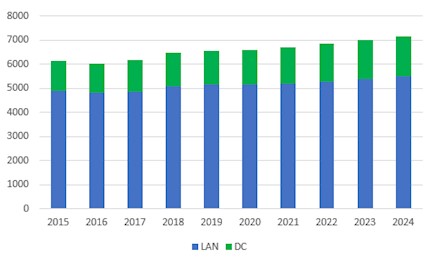

In 2019, growth in the global structured cabling market proved to be modest. BSRIA research shows growth of 1.2% and the market reaching value of USD 6.8 billion in 2019. This comes after a very good year in 2018, when an increase of almost 5% was recorded. The data centre segment performed better than the Local Area Network (LAN) segment, increasing by almost 3% in 2019, but it is worth noting that it has been half the growth rate when compared to 2018.

[edit] The LAN segment

The LAN segment increased modestly after an exceptional 5% growth year in 2018.

As of end of March 2020, BSRIA’s research forecasts minor growth below 1% for the global market in 2020 and a modest yearly increase up to 2024. The data centre segment remains a more exciting area for growth than LAN.

The global structured cabling market segmented by LAN and DC applications, USD million. Source: BSRIA Research.

The overall growth is impacted by the US market, which accounts for 36% of the global structured cabling market. The US cabling market experienced a decent year in 2019 with a 2.5% increase following a very good year in 2018 with an increase of over 4%. This was supported by the country’s economic growth, an increase in non-residential construction and a good uptake of Cat 6A.

Many of the remaining key countries performed well in 2018, such as China, Canada, UK, Germany, France and South Korea, all posting growth above 4%. In 2019 only Germany did well, while most countries showed moderate growth or experienced a decrease such as China, the UK, Switzerland and Mexico (measured in USD value).

[edit] Cat 6A sales

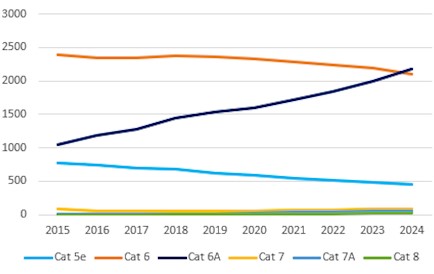

Sales of Cat 6A increased almost 7% globally in 2019 and accounts for 33% of all cabling systems by value. Sales of Cat 6a are estimated to progress dynamically up to 2024.

The global structured cabling market. Source: BSRIA Research.

Sales of Cat 7, 7a and Cat 8 are expected to show high growth rates, but from a small base. The share for the three categories combined are expected to grow from 1.7% in 2019 to 3.7% in 2024. Sales of Cat 8 are not anticipated to take off.

Sales of Cat 5e continue to decline but still accounted for 14% in 2019 - sold mainly in the USA, China and Japan.

Cat 6, which currently dominates the market, is expected to decline slightly in the future.

BSRIA has just released a new global study on the structured cabling market, which includes 16 in-depth country analysis and a world overview covering 33 countries and South East Asia.

This article was originally published under the title, Structured cabling market is slowing down despite growing demand from data centres, by BSRIA in May 2020.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.