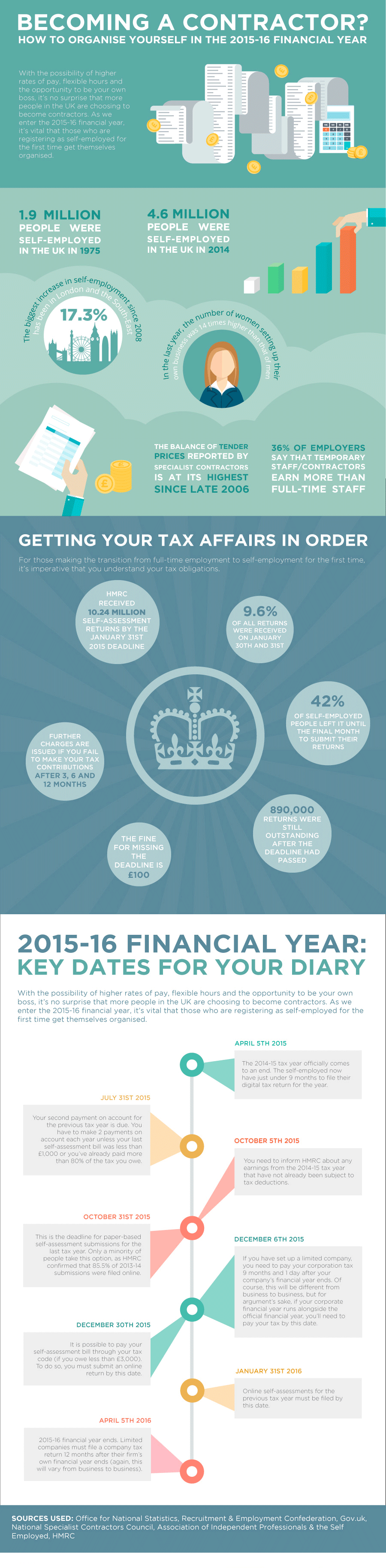

Becoming a contractor infographic

If you’ve always been a full-time employee, it’s possible that you’ve never given a second thought to how the financial year runs. If you plan to become self-employed, however, your schedule will change dramatically. The start of the financial year is April 6th, and it’s vital that new contractors familiarise themselves with key tax deadlines and dates.

Your tax obligations will ultimately depend on your circumstances. If you’ve simply registered as a sole trader, you’ll need to submit a self-assessment return by the end of October (for paper-based returns) or by the end of January (if you plan to make your submission online). Paper returns may be just a few years from extinction, as HM Revenue and Customs (HMRC) is increasingly encouraging people to make digital submissions. More than 85% of taxpayers made online submissions in 2014 - 2015.

If you’ve registered as a limited company, you’ll have other responsibilities to take into account. You need to make your corporation tax contributions nine months and one day after your company’s financial year ends, so it’s crucial that you get your dates right. HMRC is very strict when it comes to late or failed payments.

To ensure that your tax affairs are in good order right from the very start, the infographic below can help you get organised. The statistics highlight the fact that more people in the UK are becoming self-employed, and that the number of self-assessment submissions being handled by HMRC each year is on the rise. They also show that despite the threat of financial penalties for late submissions, many self-assessments are left until the very last minute – a risky thing to do. The timeline shows the key dates that sole traders and limited company owners need to follow.

See more Construction industry infographics.

--Quantic UK 10:19, 16 March 2015 (UTC)

Featured articles and news

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.