Construction knowledge survey results

Contents |

[edit] Introduction

Knowledge is a vital and expensive asset. It creates the framework within which the construction industry operates, setting the boundaries for acceptable practice, describing what we need to know and defining what is possible.

|

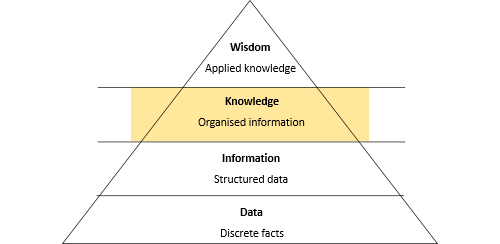

| Knowledge is distinct from data and information in that it has been organised so that it can be applied. |

During November 2018, construction industry practitioners were invited to take part in a survey created by the Construction Knowledge Task Group (CKTG) to help understand how knowledge is used by the industry and how it can be improved.

The survey was prepared following research carried out in 2017 and a series of follow-up meetings in 2018 that suggested the emergence of the internet and digital technologies mean the way knowledge is prepared, formatted and disseminated needs to change. Whilst the advent of BIM has taken data and information into the 21st century, knowledge is still prepared and shared as it if is going to be printed and will sit on a shelf.

The survey was intended to obtain quantitative and qualitative feedback from practitioners about the types of knowledge they use, where they find it, whether they trust it, what barriers they encounter and how it might be improved. It was distributed to the membership and other networks of the organisations that form the CKTG.

[edit] Who took part

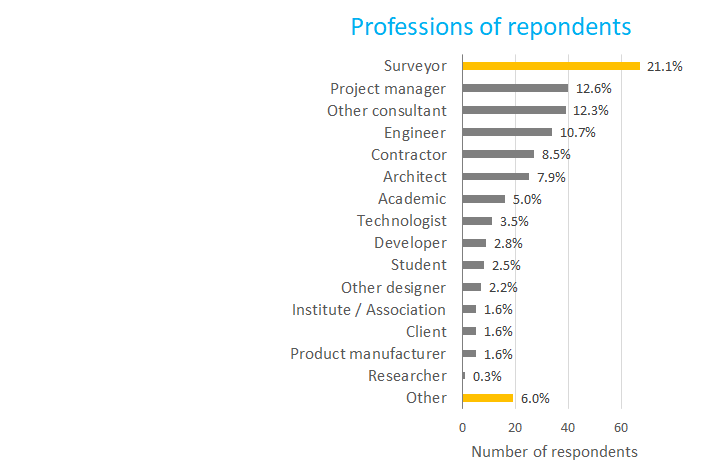

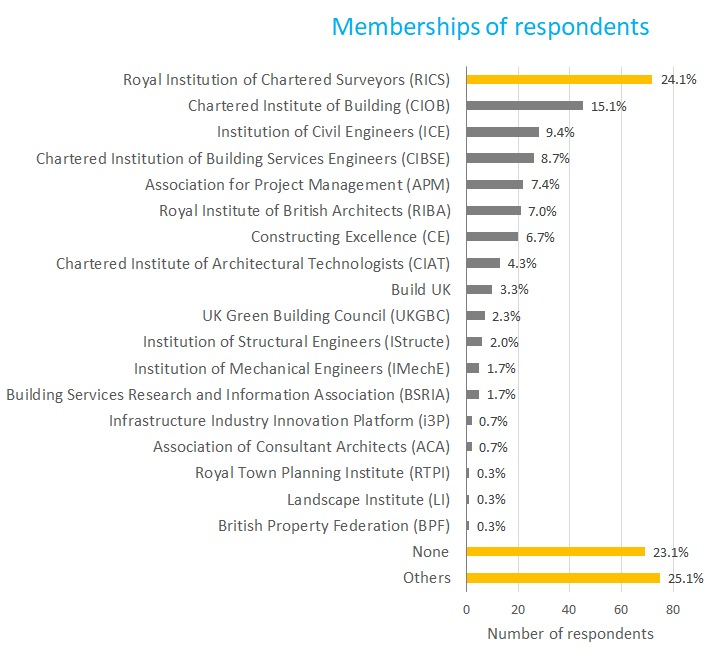

299 practitioners completed the survey, including surveyors, project managers, engineers, architects and many more. The sample was large and diverse enough to allow reasonable conclusions to be drawn about the state of knowledge across the construction industry.

The vast majority of respondents were from the UK (86%), and 87% were members of industry institutes or associations. It is likely that many also benefit from corporate memberships that they might not have listed.

[edit] The results

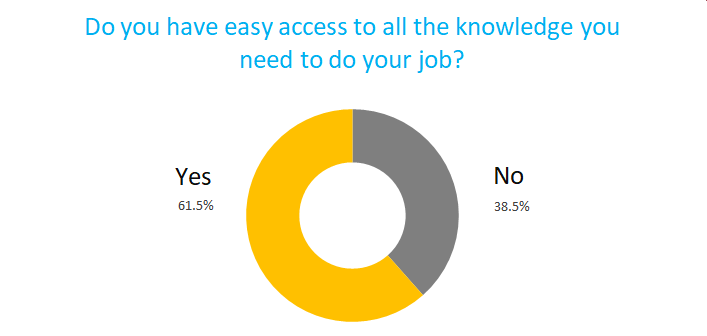

In response to the main headline question, more than a third of practitioners admitted they did not have easy access to all the knowledge they need to do their job. This begs the question – are they doing without some knowledge, and if so, how critical is it?

[edit] What knowledge do people use?

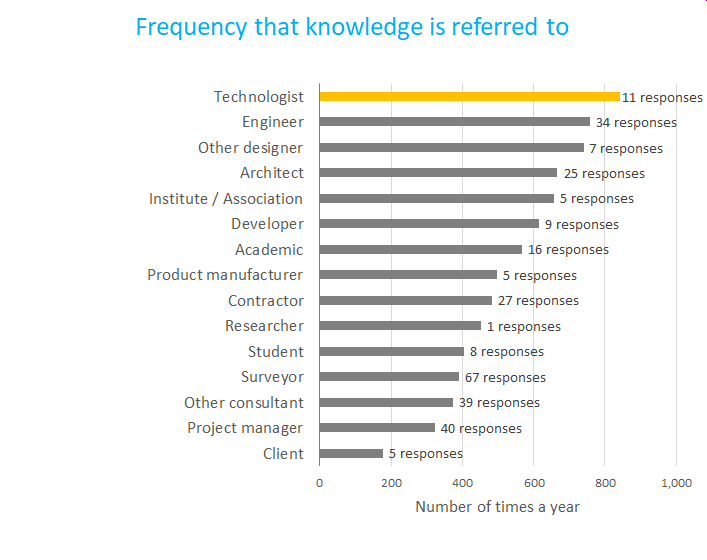

The frequency with which different types of practitioner refer to knowledge was analysed.

The number of respondents from some groups was very low and so these results should be treated with caution. However, whilst it is not possible to draw absolute conclusions based on these small sample sizes, very broadly it appears that the most frequent consumers of knowledge are designers, whilst decision makers use knowledge least frequently.

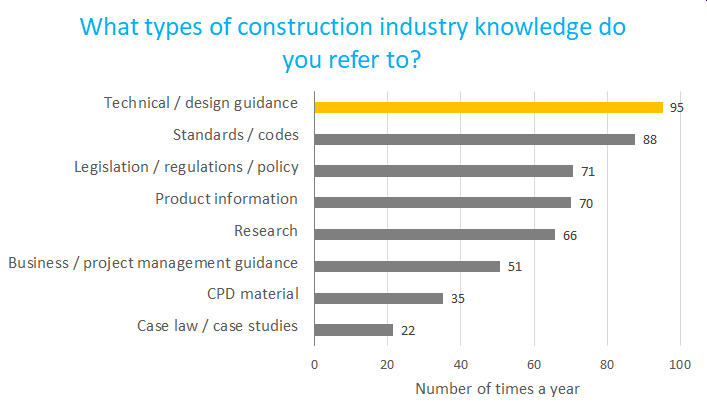

In response to the question 'what types of knowledge do you refer to?' practitioners appear to access practical knowledge that is necessary for their day-to-day activities most frequently. This backs up the research carried out in 2017 which suggested people are searching for answers to help them solve problems or to understand the industry better. Knowledge that is imparts more traditional ‘learning’ is accessed less frequently.

Other types of knowledge respondents say they refer to include; data, indices, market research, project information, and personal experience.

[edit] What are the most popular sources of knowledge?

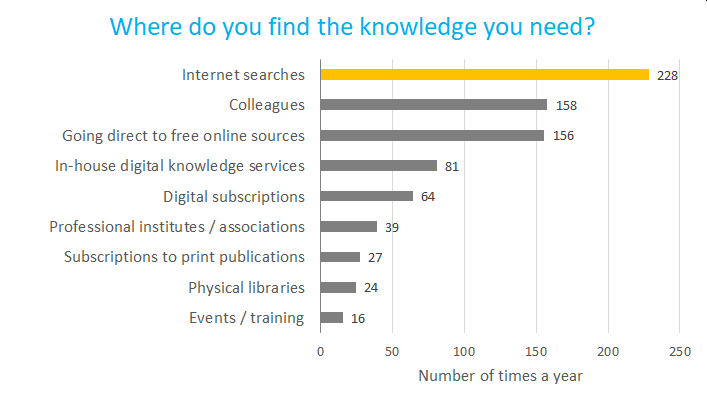

The internet is the most frequently-used source of knowledge, with web searches and free online sources accounting for almost 50% of the knowledge accessed.

It is notable that the 3 most popular sources of knowledge are self-directed ‘informal’ sources, that is, they are not provided through subscriptions, industry bodies or employers. The more formal, controlled sources of knowledge which might be provided by subscriptions, industry bodies or employers are the 6 least popular sources. This may be a concern to organisations wishing to structure or optimise the knowledge their employees use.

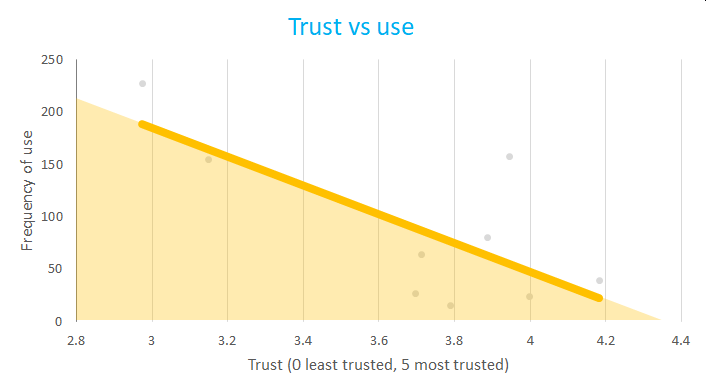

However, it is interesting to note that when practitioners were asked which of these sources they trusted the most, the picture was reversed, with formal knowledge sources coming out on top.

This reveals a perverse situation in which (in very general terms) the knowledge sources practitioners use the most are also the ones they trust the least.

Other sources of knowledge respondents said they use include:

- Newsletters, social media (in particular Linkedin), forums and video.

- Specialists, suppliers and consultants.

- Personal or corporate networks.

- Government resources.

[edit] The barriers to accessing and using knowledge

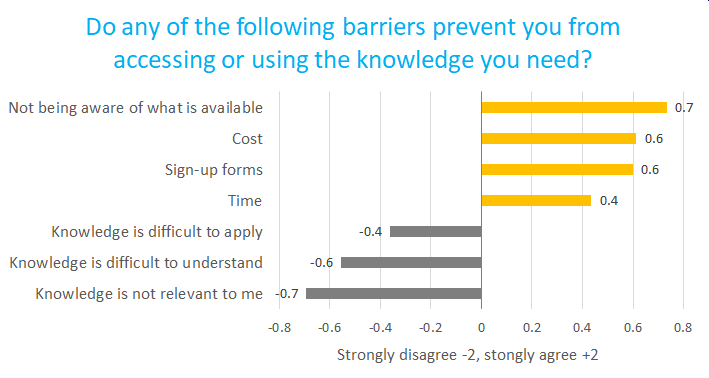

Respondents' answers about the knowledge barriers they face reveal they are largely concerned about difficulties accessing knowledge in the first place, rather than any subsequent problems they might encounter trying use that knowledge.

The main barrier was simply not being aware of what is out there, with respondents' comments suggesting they are overwhelmed by the amount of knowledge available, confused by contradictory knowledge, and frustrated by the number of silos they have to search to find what they need.

Surprisingly, sign-up forms ranked almost as highly as cost in terms of barriers to access. This may be because many practitioners subscription services are paid for by their employers. However, SME’s and sole practitioners commented that the cost of accessing knowledge was a significant problem for them.

In terms of the content of knowledge itself, practitioners complained about the length of documents, a lack of specific information, a lack of worked examples and the prevalence of unhelpful marketing material compared to useful practical guidance. There were also calls for better access to material that has been archived or withdrawn, and for translated material for non-UK practitioners.

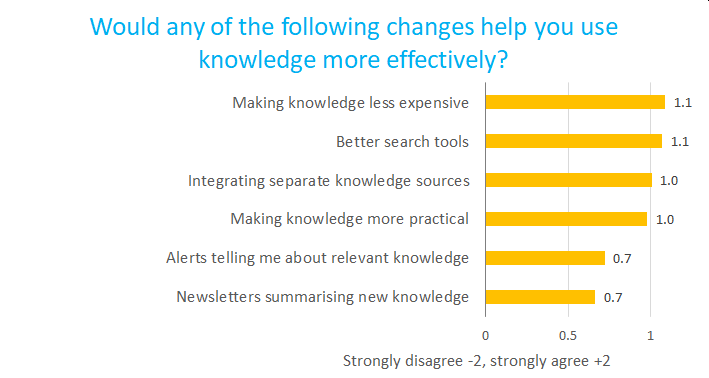

[edit] Possible changes to industry knowledge

There was general support for all the proposed methods for improving industry knowledge. The most popular 3 suggestions focused on delivering better access on demand; that is, practitioners want to be able to find what they need when they need it. There was less call for being actively informed about knowledge by newsletters or alerts.

Many of the comments about potential improvements related to creating a single method for accessing all knowledge sources, and the use of artificial intelligence to help personalise results based on individual priorities, the level of detail required, professional specialisms and so on.

[edit] Open comments

Respondents used the open-ended section at the end of the survey to make a wide range of comments. Many of these implied there is a ‘them and us’ culture, in which subscribers have easy access to knowledge but non-subscribers do not. This was a particular problem for SME’s and sole practitioners, but it was also raised as an issue by practitioners in larger organisations who can find themselves involved in new subject areas for one-off projects.

The industry was also criticised for being disconnected, for not being open enough, and for using its resources to disseminate marketing material rather than useful knowledge.

[edit] Conclusion / next steps

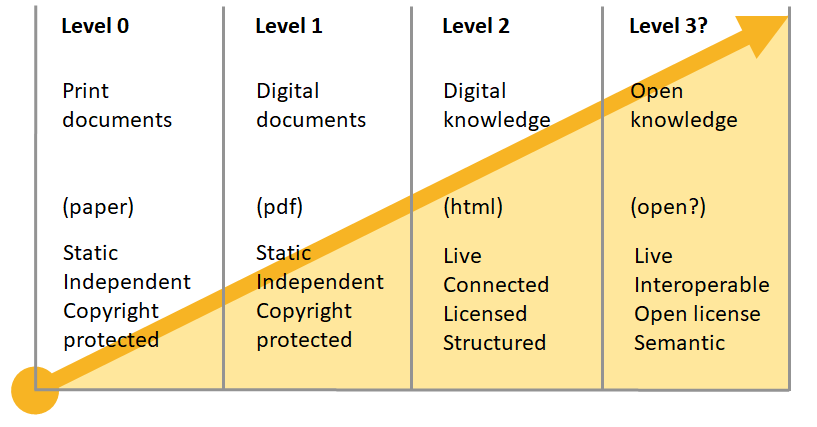

It is clear that there is a long way to go to bring construction industry knowledge into the 21st century. BIM has shown the way with the standardisation, management and sharing of data and information, but to date, knowledge has not received the same rigorous attention.

Knowledge needs to be treated as an industry asset. We use significant resources to create knowledge, and we need to maximise the value the industry is able to extract from it.

|

| Using the analogy of BIM maturity levels, knowledge needs to be moved from level 1 to at least level 2. |

This survey suggests that the future should be one in which knowledge is better integrated, in fewer silos, is more easy-to-access and available through more flexible subscriptions. It suggests that intelligent search tools should be created to help individuals find the knowledge they need on demand.

The CKTG will take up this challenge and will meet in January to discuss how to drive this agenda forward.

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.