Disbursement

A disbursement is a type of payment which is made from a bank account or other funds, or a payment that a third party such as a solicitor makes on behalf of their client for which they are entitled to reimbursement.

Common examples of disbursements include money paid out for the running of a business, cash expenditures, dividend payments, and payments made by an organisation’s solicitor to third parties for certain fees (e.g. court, medical, courier fees, expert reports, etc.).

During the conveyancing process, a disbursement is a type of payment made when property ownership is transferred from one party to another. Disbursements are not part of a solicitor’s basic fee, nor are they additional charges for which the solicitor receives a commission; instead they relate to various fees and taxes that must be paid.

The most common disbursements that can apply to property purchases include:

- Stamp duty land tax.

- Land Registry fees (to register the change of ownership, along with details of any new mortgage on the property).

- Official copy entries and filed plans.

- Landlord’s registration fee (may be payable to the freeholder for registering details of the ownership change).

- Search fees. For more information on the various different types, see Search fees.

Some disbursements may need to be paid up-front while others will be required when the purchase completion is due. Some of the fees are of fixed amounts and can be given with the original quote, however, others are variable and will be determined by the property purchase price or the particular charging structure of local authorities.

If a disbursement is collected by a solicitor but then payment of it is no longer required, it must be returned to the client. If the amount actually paid is lower than that taken by the solicitor as a disbursement, then the balance should be refunded to the client.

While some clients may wish to handle the conveyancing process themselves, thereby avoiding having to hire a solicitor, in practice it is can be convenient to use a solicitor to make such payments. This can be because some organisations only accept payments through solicitors and do not directly deal with the public, or because the solicitor has an existing account with a particular organisation. Also, a solicitor is responsible for making sure all relevant payments are made sp that the property purchase can go through as easily as possible, and the layperson may not be fully aware of all those payments that are required.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

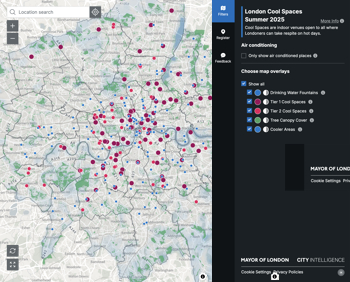

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).