About Tim Emery

How do we keep investors interested in UK property?

I would like to start by saying that I am a first year university student with no experience of the industry, so I am simply drawing from my own observations and experiences.

Such is the level of anomalous growth in London compared to the rest of the UK that I think we have to treat it as a separate situation. Whilst for the majority of the UK, the question is how to keep investors interested in UK property, I think in London the question is how do we manage the growth in property investment to ensure it is sustainable. As we have seen many times before a buoyant property market that is limited to a capital city can often cause unsustainable growth driven by greed, based on foreign investment, with little foresight. As someone passionate about the diverse cultures that currently thrive in London, what may happen to those cultures if luxury property in the capital is left dormant for much of the year due to foreign ownership and the general population are priced out of the market in swathes of the city? So I suppose there would have to be an active effort driven by banks with governmental support to regulate the sector in a way that would be beneficial for all parties to ensure the property bubble surrounding London does not burst.

So then we move over to the question of attracting investment to the rest of the UK. Whilst the property market is in the process of recovery, many people are still finding it very difficult to find a buyer for their house at this time. However, when my parents sold their house of 16 years earlier this year it sold within a week of going on the market. What was clear is that this was due to its location and surrounding infrastructure. It was situated within walking distance to a recently opened, very sought after secondary school, was close to the local shops and was in an area that had good rail links into London. If we compare that to a family friend who is also trying to sell their house not 8 miles away, despite lowering the asking price is still struggling to find a buyer after 9 months. So really I think making the UK continually attractive to property investors is conditional on infrastructure. Though it would be easy to look to governmental investment in schools etc. in more deprived areas, due to the continuing economic burden this would be unrealistic. Instead I believe we need to look to private industry to attract outside investors. I think the creation of jobs in areas of potential development would make these areas more appealing to investors, but also ensure the private industry firms be well placed to receive the new residents into working positions, which will in tern bring retail companies to the area due to the higher levels of employment and disposable income. I think this would not only attract investors, but would be beneficial to the economic recovery, with the final piece of the puzzle being eventual governmental investment in education in these areas to safeguard the continued growth.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

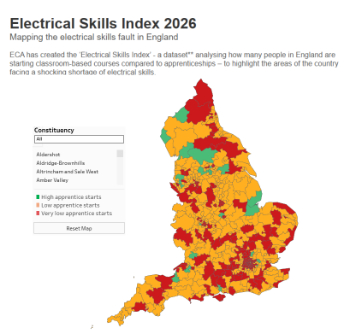

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.