About Graham Evans

Property Development and Planning student (RICS & RTPI accredited)at Heriot-Watt University and a student member of the RICS.

Whilst London is the epicentre of UK real estate investment and a globally recognised safe-haven for investment, the regions tend to struggle by comparison. One of many reasons it is unlikely the London 'bubble' will burst is because most foreign companies entering the UK market will 'test the water' in London. As Crossrail helps London prices forge even further ahead, it is important to respond to the regional inefficiency of attracting investment.

As German and Swiss real estate (for example) offer greater diversification it could be argued that it will not be too long before cash-rich investors look to spend in major global markets outside of the UK. The pervasive strength of the German economy will continue to produce investment funds that will help boost development across other EU countries; but funds may not consider the UK if it were no longer in the Eurozone as this would almost definitely have tax implications.

With the aforementioned problems in mind this proposal takes inspiration from the Swiss system of property taxation. By offering differing tax rates for property investment throughout the regions, the UK could increase opportunities and hold the attention of investors.

The Swiss economy remained relatively unscathed by the economic crisis and sub-prime chaos of late 2008, and the real estate market continued to be an attractive investment location. Tax remains low in comparison to many jurisdictions albeit the system is complex. Swiss real estate investment allows variation in rates across the regions (cantons) and real estate will always be taxed in the region in which it is located. Corporation tax, taxes upon acquisition, capital gains tax, and annual capital tax are all dependant on location.

Implementing such a system would allow for better regional competition and would spread investment across the UK. Essentially this system would allow companies which originally invested in London to gain greater exposure to the regional markets with a better yield potential. There would be an overall boost to the economy and the UK could avoid the risk of losing investors to other global markets.

Featured articles and news

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

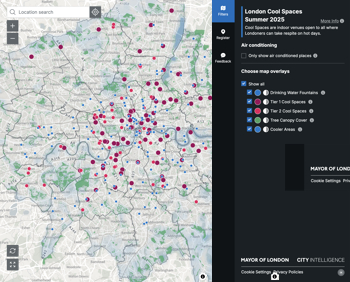

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).

Ebenezer Howard: inventor of the garden city. Book review.

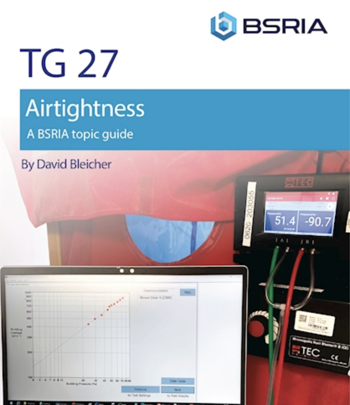

Airtightness Topic Guide BSRIA TG 27/2025

Explaining the basics of airtightness, what it is, why it's important, when it's required and how it's carried out.