New apprenticeship levy

Chancellor George Osborne, in his November 2015 Spending Review, set out a new apprenticeship levy to come into force in April 2017. The new levy has been set at 0.5% of an employer’s wage bill and will only apply to firms who pay out on wages more than £3m a year. This is expected to have implications for more than 700 mainstream contractors and housebuilders across the construction industry.

Read more about the apprenticeship levy here.

Firms with pay bills lower than £3m a year will be exempt; a move apparently designed to remove the threat to contractors of having to pay two apprentice levies, the new one and the pre-existing Construction Industry Training Board (CITB) scheme.

The CITB’s levy charge is also set at 0.5%, although it applies at a much lower payroll threshold of £80,000 and includes extra charges dependent upon the number of labour-only subcontractors used by a firm. With their reliance on subcontracted labour, most construction firms employ few people, relative to their turnover, which has raised concerns over the future viability of the CITB who could see their income slashed as a result. Justifying this fear somewhat is the fact that many major contractors have already announced that they will refuse to pay two levies for training.

Currently, around 60% of apprenticeships are delivered by small and micro firms. Accordingly, the hope is that these firms, exempt from paying the national levy, will agree to develop apprenticeship training programmes that will enable them to get out more from the scheme than they pay in.

James Wates, CITB chairman said: “While the announcement regarding the Apprenticeship Levy creates a challenging environment for CITB across Great Britain, we will continue to support industry and work with government to ensure the best possible outcome. Our next step is to engage in extensive consultation with employers and work out the most effective way to continue providing the construction industry with the skills and training it needs.”

Suzannah Nichol, chief executive of contractors trade body UK Build, said: “We are meeting skills minister Nick Boles in a few weeks to talk through how this will work. The key thing is the new levy must work for industry because we desperately need skills to deliver capacity in a growing industry.”

The Chartered Institute of Building (CIOB) also voiced their concern. Policy officer David Hawkes said: “Although we welcome the news of a further three million apprenticeship starts by 2020, shifting the emphasis on firms to train their own staff, the government must work closely alongside professional bodies and employers to design and implement high quality, robust standards that meet the needs of the construction industry. Furthermore, clarity on the role of the CITB moving forward must be made to give confidence to employers.”

In May 2016, CITB announced it was considering transitional arrangements involving a rebate to large contractors to ensure that they did not have to pay two levies. An announcement is expected in July.

Read more about the CITB here.

In March 2017, the cross-party sub-committee on Education, Skills and the Economy criticised the scheme, saying, “We recommend that the government, as part of its continuing review of the operation of the levy, consider whether a single rate is the best approach and explore ways of restructuring the levy on a sectoral and regional basis…. The government has not set out how its increase in apprenticeship numbers will help fill the country’s skills gaps. The current balance of provision is skewed towards sectors with low wage returns and few skills shortages and we are not convinced that tinkering will bring about the major changes necessary.”

The levy went live in April 2017.

Julia Evans, Chief Executive, BSRIA, said: “Apprenticeships provide the backbone for a career in engineering for many employees and no compromises should be made regarding them... In essence: the levy must meet industry and apprenticeship needs."

BSRIA suggested that industry concerns included:

- Some firms face paying for the levy but being unable to access new or updated training standards, or have no approved providers available locally.

- A lack of accessible information for employers about the government’s list of approved providers and their quality of training.

- Government should give employers longer than 24 months to spend their levy vouchers, if current issues remain unresolved in the first year.

- Ineffective careers guidance in schools about available apprenticeship options.

- The government should consider a more flexible skills levy, to not only support apprentices, but also retraining for adults.

[edit] Related articles on Designing Buildings Wiki

- 2015 Emergency Budget.

- Achieving carbon targets and bridging the skills gap.

- Apprenticeships levy.

- Boardroom to building site skills gap survey.

- Construction apprenticeships.

- Construction Industry Training Board.

- Hourly rate.

- Interview with CITB

- National Infrastructure Plan for Skills.

- New apprentice levy funding model.

- Perkins review of engineering skills.

- Protection for apprenticeships.

- Skills shortage.

- Skills to build (November 2014 report).

- Tackling the construction skills shortage (KLH Sustainability blog post November 2014).

Featured articles and news

Investors in People: CIOB achieves gold

Reflecting a commitment to employees and members.

Scratching beneath the surface; a guide to selection.

ECA 2024 Apprentice of the Year Award

Entries open for submission until May 31.

UK gov apprenticeship funding from April 2024

Brief summary the policy paper updated in March.

For the World Autism Awareness Month of April.

70+ experts appointed to public sector fire safety framework

The Fire Safety (FS2) Framework from LHC Procurement.

Project and programme management codes of practice

CIOB publications for built environment professionals.

The ECA Industry Awards 2024 now open !

Recognising the best in the electrotechnical industry.

Sustainable development concepts decade by decade.

The regenerative structural engineer

A call for design that will repair the natural world.

Buildings that mimic the restorative aspects found in nature.

CIAT publishes Principal Designer Competency Framework

For those considering applying for registration as a PD.

BSRIA Building Reg's guidance: The second staircase

An overview focusing on aspects which most affect the building services industry.

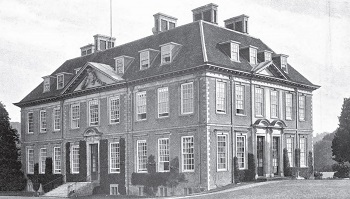

Design codes and pattern books

Harmonious proportions and golden sections.

Introducing or next Guest Editor Arun Baybars

Practising architect and design panel review member.

Quick summary by size, shape, test, material, use or bonding..