Capital expenditure for construction

Capital expenditure (sometimes abbreviated as Capex, CAPEX or CapEx) is one-off expenditure that results in the acquisition, construction or enhancement of significant fixed assets including land, buildings and equipment that will be of use or benefit for more than one financial year.

Whilst it is generally relatively straight forward to identify expenditure necessary to acquire or construct fixed assets, distinguishing between enhancements and expenditure such as repairs, maintenance, or replacement can be difficult. Very broadly, enhancements should either:

- Significantly lengthen the life of the asset.

- Significantly increase the value of the asset.

- Significantly increase usefulness of the asset.

Capital expenditure is often distinguished from operational expenditure (OPEX sometimes referred to as 'revenue expenditure'). This is expenditure incurred in day-to-day operations, such as; wages, utilities, maintenance and repairs, rent, sales, general and administrative expenses, and so on.

In construction, capex and opex can be considered to be associated with separate, distinct stages, with capital expenditure during acquisition and construction, and then a ‘handover’ to operational expenditure when the client takes possession of the completed development.

Capex and Opex can be seen as competing needs, with higher capital expenditure often resulting in lower operational expenditure, as a higher quality asset may have lower maintenance and repair costs, lower utilities costs, and so on. While sometimes the division between capital and operational expenditure can be one of necessity, based on the resources available to the client at the time, it can be the result of an assessment of whole-life costs.

Whole life costs consider all costs associated with the life of a building including:

- Acquisition.

- Fees

- Construction.

- Insurance, inflation and financing.

- Fixtures, fittings and equipment.

- Relocation.

- Operation.

- Disposal.

Whilst it is often tempting to seek savings in the early stages of a project, the relative benefit of this tends to be outweighed by the long-term impact.

This is sometimes demonstrated by a rough assessment of the typical costs of an office building over 30 years, in the ratio:

- 0.1 to 0.15 for design costs (ref. OGC Achieving Excellence Guide 7 - Whole-Life costing).

- 1 for construction costs.

- 5 for maintenance and building operating costs during the lifetime of the building.

- 200 for the cost of operating the business during the lifetime of the building.

(Ref. Report of the Royal Academy of Engineering on The long term costs of owning and using buildings (1998).)

However, this has been criticised as misleading, not least because the construction industry accounts for around 7% of GDP, implying a much more significant proportion of business costs than the ratio suggests. Other ratios of construction costs to operational costs to business costs have suggested figures as low as 1:0.6:6 for some types of buildings. However, the usefulness of these ratios is questionable, other than if they are calculated based on actual figures for specific businesses.

[edit] Related articles on Designing Buildings Wiki

- Budget.

- Business plan.

- Capital allowances.

- Capital costs.

- Construction project funding.

- Cost plans.

- ECA welcomes the Value Toolkit for the construction industry.

- Is hydrogen the heating fuel of the future?

- Life cycle assessment.

- Net Present Value.

- New Rules of Measurement.

- Opex.

- Value management.

- Value.

- Whole life costs.

Featured articles and news

Sir John Betjeman’s love of Victorian church architecture.

Exchange for Change for UK deposit return scheme

The UK Deposit Management Organisation established to deliver Deposit Return Scheme unveils trading name.

A guide to integrating heat pumps

As the Future Homes Standard approaches Future Homes Hub publishes hints and tips for Architects and Architectural Technologists.

BSR as a standalone body; statements, key roles, context

Statements from key figures in key and changing roles.

ECA launches Welsh Election Manifesto

ECA calls on political parties at 100 day milestone to the Senedd elections.

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

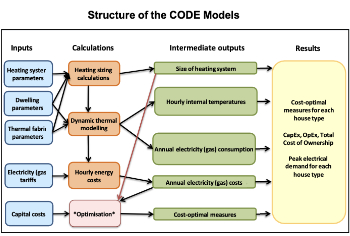

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

Comments

This article was helpful,and quite elaborate.Thanks to the author