Operational expenditure for built assets

Operational expenditure (opex, sometimes referred to as revenue expenditure) is expenditure incurred as a result of the day-to-day operations of a business. Operational expenditure might include expenditure such as; wages, utilities costs, maintenance and repairs, rent, sales, general and administrative expenses.

Operational expenditure is often distinguished form capital expenditure (capex), which is expenditure incurred in the acquisition, construction or enhancement of significant fixed assets including land, buildings and equipment that will be of use or benefit for more than one financial year.

Whilst it is generally relatively straight forward to identify expenditure to acquire or construct fixed assets, distinguishing between enhancements and operational expenditure such as repairs, maintenance, or replacement can be difficult. Very broadly, enhancements should either:

- Significantly lengthen the life of the asset

- Significantly increase the value of the asset.

- Significantly increase usefulness of the asset.

In construction, capex and opex can be considered to be associated with separate, distinct stages, with capital expenditure during acquisition and construction, and then a ‘handover’ to operational expenditure when the client takes possession of the completed development.

Capex and opex can be seen as competing needs, with higher capital expenditure often resulting in lower operational expenditure, as a higher quality asset may have lower maintenance and repair costs, lower utilities costs, and so on. Whilst sometimes the division between capital and operational expenditure can be one of necessity, based on the resources available to the client at the time, it can be based on an assessment of whole-life costs

Whole life costs consider all costs associated with the life of a building including:

- Acquisition.

- Fees

- Construction.

- Insurance, inflation and financing.

- Fixtures, fittings and equipment.

- Relocation.

- Operation.

- Disposal.

Whilst it is often tempting to seek savings in the early stages of a project, the relative benefit of this tends to be outweighed by the long-term impact.

This is sometimes demonstrated by a rough assessment of the typical costs of an office building over 30 years, in the ratio:

- 0.1 to 0.15 for design costs (ref OGC Achieving Excellence Guide 7 - Whole-Life costing).

- 1 for construction costs.

- 5 for maintenance and building operating costs during the lifetime of the building.

- 200 for the cost of operating the business during the lifetime of the building.

(Ref. Report of the Royal Academy of Engineering on The long term costs of owning and using buildings (1998).)

However, this has been criticised as misleading, not least because the construction industry accounts for around 7% of GDP, implying a much more significant proportion of business costs than the ratio suggests. Other ratios of construction costs to operational costs to business costs have suggested figures as low as 1:0.6:6 for some types of buildings. However, the usefulness of these ratios is questionable, other than if they are calculated based on actual figures for specific businesses.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

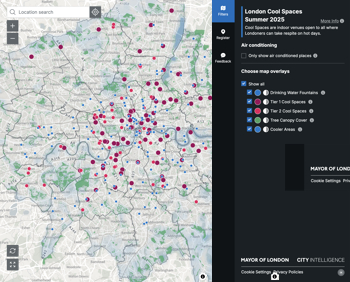

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).