Legal indemnities for property

Contents |

[edit] Introduction

Solicitors encounter various problems in their daily dealings which can often be solved by the use of an insurance policy. Listed below are the problems most commonly encountered. It is often possible to provide an insurance solution to problems that may appear insoluble.

[edit] Defective title

The policy will indemnify the purchasers and their successors in title and mortgagees in respect of capital loss and expenses arising from the specified defect in the title, should an estate right or interest adverse to or in derogation of the purchaser’s title to the property be established.

Below are listed some of the more common difficulties associated with defective titles.

[edit] Lack of assents

An indemnity can be provided against loss sustained due to the past failure of legal representatives to assent to the vesting of the property in themselves or other beneficiaries.

[edit] Deeds of gift and conveyances at an undervalue

An indemnity can be provided to mortgagees and purchasers from donees, to cover situations where a deed or conveyance is declared void under Section 339 of the Insolvency Act 1986.

[edit] Discharge of mortgage

An indemnity can be provided in respect of the absence of vacating receipts or similar acceptable documentary evidence proving the discharge of a mortgage.

[edit] Lack of easements

An indemnity can be provided in respect of claims to prohibit the use of sewers, water pipes and other services which have been constructed through land without formal easements having been granted.

[edit] Erroneous or inadequate descriptions of land

When the description of land in title deeds is not clear and there is doubt as to whether the whole of the land now being sold was included in previous conveyances, an indemnity can be provided against adverse claims to the title.

[edit] Land charge

If a land charges or local land charges search reveals a charge about which it is not possible to obtain full details, nor removal from the register, an indemnity can be provided in respect of loss which its existence may subsequently cause.

[edit] Lost documents of title

An indemnity can be provided in respect of adverse claims arising due to the loss of all or some of the title deeds to a property.

[edit] Possessory title

Where land has been acquired by adverse possession an indemnity can be provided against claims in derogation of the possessor’s title. The policy will enable the vendor to offer a marketable title.

[edit] Powers of attorney

Indemnities can be provided where the use of an incorrect wording in a power of attorney results in a vendor being unable to show good title.

[edit] Rights of way

[edit] Absence of easements

When a property lacks necessary access rights over adjoining land, a policy can be arranged to provide an indemnity in respect of capital loss and expenses should a third party attempt to prevent the land being used as access to the property.

[edit] Adverse third party rights

An indemnity can be arranged when property is (or may be) subject to rights of way. Cover is available where the rights have not been exercised for a number of years but if exercised would adversely affect the value of the property.

[edit] Restrictive covenants

Restrictive covenants can hinder development and make the sale of land or the raising of mortgage finance difficult. When the use or proposed use of a property breaches restrictive covenants we can arrange an indemnity in respect of capital loss, damages and expenses arising from persons claiming the benefit of the restrictive covenants and exercising or attempting to exercise their right to enforce them.

[edit] Leasehold indemnities

[edit] Rights of support

When a residential lease contains no or inadequate rights of support it will often be viewed as unacceptable security by mortgagees. An indemnity can be provided to the mortgagee in respect of any deficiency in the mortgage account due to the absence of or defect in repairing covenants.

[edit] Bankruptcy clause

Where a residential lease gives the lessor the right of re-entry in the event of the lessee becoming bankrupt or entering into arrangements with creditors, the property can be rendered mortgage-able by providing indemnities to mortgagees.

[edit] Contingent fire indemnity

An annual policy can be provided to protect both the lessee and the mortgagee in respect of loss due to the failure of the lessor or the adjoining lessees to effect and/or maintain adequate insurance as required by the lease.

[edit] Miscellaneous

[edit] Sewer indemnities

Local authorities will often grant planning permission for the erection of buildings over sewers provided that the owner of the building undertakes to pay for any increase in the cost of carrying out repairs to the sewer due to the existence of the building. An indemnity can be provided in respect of this extra liability if a call for payment is made.

[edit] Railway lease indemnities

British Rail leases normally include a clause which allows it to terminate the lease, without payment of compensation, should it require the property “for the purpose of its undertaking”. This situation can arise if British Rail decides to construct new lines or stations or carry out major repairs. The policy protects the Insured against the loss of residual value of the lease and all reasonable costs and expenses incurred.

[edit]

An insurance company can act as a guarantor by countersigning the Letter of Indemnity normally required by Life Offices, Issuing Companies or Registrars before the proceeds can be paid over or a duplicate issued. The indemnity protects the Life Office, Issuing Company or its Registrar should the owner not comply with the terms of the Letter of Indemnity.

[edit] Related articles on Designing Buildings Wiki

- Buy-to-let mortgage.

- Contractors' all-risk insurance.

- Defects.

- Directors and officers insurance.

- Easements.

- Hold harmless agreement.

- Indemnity.

- Joint names policy.

- Legal indemnity insurance.

- Mechanic’s lien.

- Professional indemnity insurance.

- Property ownership.

- Property rights.

- Restrictive covenants.

- Rights of way.

- What is a mortgage?

[edit] External references

Featured articles and news

Net zero electricity grids BSRIA guide NZG 5/2024

Outlining the changes needed to transition to net zero.

CIOB Global Student Challenge 2024

Universitas Indonesia wins for second year running.

New project and cultural district described in detail.

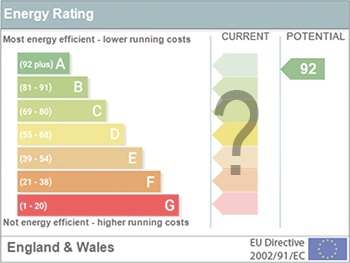

The nature of EPCs, crticism and inaccuracies.

History, issues and redesign.

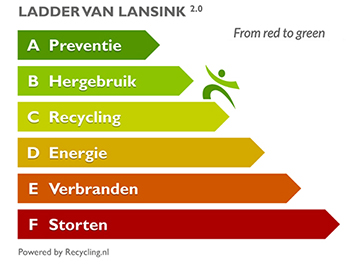

From waste recycling to energy performance the hierchy.

An introduction to WERCS and WEEE responsibilities

Dealing 2 million tonnes of waste equipment a year.

Global BACS Market: analytics and optimisation

A BSRIA glance at building automation and control systems.

What it is and how to use it.

Types of insulating plaster by binder and insulant.

Investors in People: CIOB achieves gold

Reflecting a commitment to employees and members.

Scratching beneath the surface; a guide to selection.

ECA 2024 Apprentice of the Year Award

Entries open for submission until May 31.

UK gov apprenticeship funding from April 2024

Brief summary the policy paper updated in March.

For the World Autism Awareness Month of April.