About B1johnson

Seems to me that the real goal would be not to have 'investors', but to have BUYERS (persons or companies that have the structure built for their actual usage).

I have been in a financial bible study recently where a real estate developer was giving the session. He said financially, he realized that by selling off his properties that were borrowed upon to build them, he could pay off 1 or 2 properties and rent them out and have the SAME income.

Borrowing is a pledge, making the borrower a servant to the lender... and with economies going crazy at the moment, it is basically gambling on the interest rates and potential returns.

If you have the money to build a project, then your return is re-couped in 2-10 years depending on the tenant.

But if you borrow, you need near full occupancy just to break even and come out with a 10-20% profit margin.

So, the core principle is that borrowing 100% of the financial need for a property many not ever pay off, especially if interest rates rise.

Find investors that take all the risk for themselves with money they have already earned... Don't speculate on potential... find tenants and build to suit... whether they rent or buy that property... commercial or residential...

Lastly, don't form partnerships... in the end, they HAVE to break up at some point... they cannot last... If you cannot do a project without partnerships, have an exit strategy in the contract.

Featured articles and news

ECA 2024 Apprentice of the Year Award

Entries open for submission until May 31.

UK gov apprenticeship funding from April 2024

Brief summary the policy paper updated in March.

For the World Autism Awareness Month of April.

70+ experts appointed to public sector fire safety framework

The Fire Safety (FS2) Framework from LHC Procurement.

Project and programme management codes of practice

CIOB publications for built environment professionals.

The ECA Industry Awards 2024 now open !

Recognising the best in the electrotechnical industry.

Sustainable development concepts decade by decade.

The regenerative structural engineer

A call for design that will repair the natural world.

Buildings that mimic the restorative aspects found in nature.

CIAT publishes Principal Designer Competency Framework

For those considering applying for registration as a PD.

BSRIA Building Reg's guidance: The second staircase

An overview focusing on aspects which most affect the building services industry.

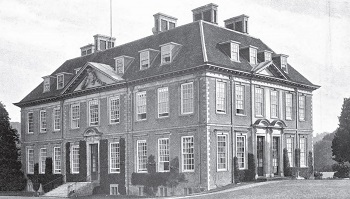

Design codes and pattern books

Harmonious proportions and golden sections.

Introducing or next Guest Editor Arun Baybars

Practising architect and design panel review member.

Quick summary by size, shape, test, material, use or bonding..